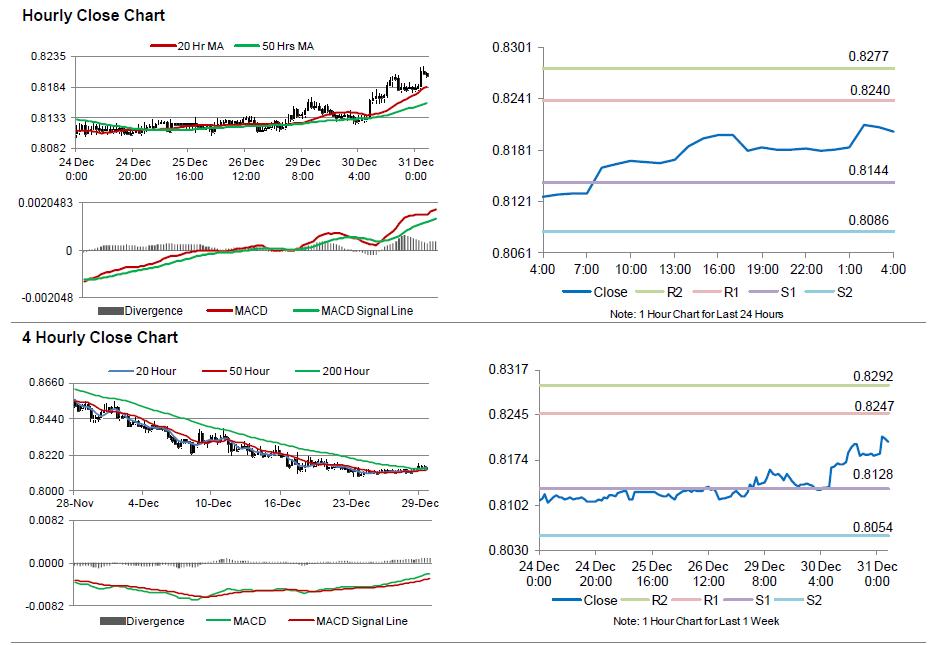

For the 24 hours to 23:00 GMT, the AUD strengthened 0.56% against the USD to close at 0.8181.

LME Copper prices marginally declined or $2.0/MT to $ 6330.0/MT. Aluminium prices rose 0.41% or $7.5/MT to $ 1835.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8203, with the AUD trading 0.26% higher from yesterday’s close, after data released early this morning indicated that private sector credit recorded a rise of 0.50% on a MoM basis in Australia, in November, compared to an advance of 0.60% in the prior month. Markets were expecting private sector credit to advance 0.50%.

Meanwhile, data from China, Australia’s largest trading partner revealed that the final HSBC/Markit manufacturing PMI index fell to a level of 49.60, compared to market expectations of a drop to 49.50. In the previous month, HSBC/Markit manufacturing PMI index had recorded a reading of 50.00. The preliminary figures had recorded a fall to 49.50.

The pair is expected to find support at 0.8144, and a fall through could take it to the next support level of 0.8086. The pair is expected to find its first resistance at 0.824, and a rise through could take it to the next resistance level of 0.8277.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.