Gold prices traded higher by 5.11% against the USD in the 24 hour period ending 23:00GMT, at 1212.20 per ounce, registering its highest 1-day gain since 2013, amid a broad weakening in the greenback.

The safe haven appeal of gold received a further boost, following dismal manufacturing PMI data in the Euro-zone and China.

Yesterday, the SPDR Gold Trust showed that its gold holdings contracted to 717.63 tons, from its previous level of 720.91 tons.

In the Asian session, at GMT0400, the pair is trading at 1204.90, with the gold trading 0.6% lower from yesterday’s close.

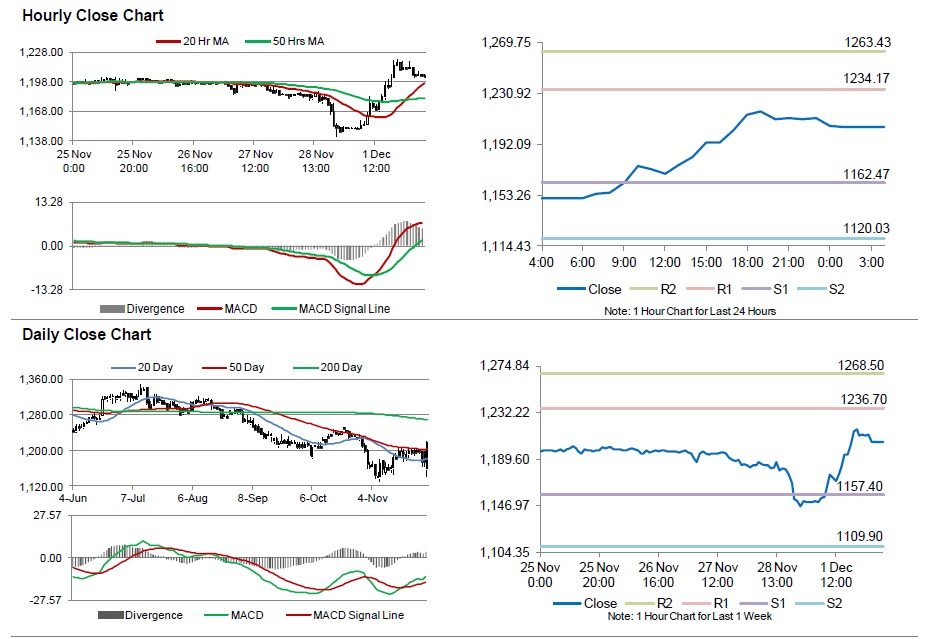

The pair is expected to find support at 1162.46, and a fall through could take it to the next support level of 1120.03. The pair is expected to find its first resistance at 1234.16, and a rise through could take it to the next resistance level of 1263.43.

The yellow metal is trading above its 20 Hr and 50 Hr moving averages.