For the 24 hours to 23:00 GMT, the AUD strengthened 0.22% against the USD to close at 0.8496.

LME Copper prices declined 2.00% or $130.5/MT to $6385.0/MT. Aluminium prices declined 2.44% or $50.5/MT to $2021.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8510, with the AUD trading 0.17% higher from yesterday’s close.

Earlier today, the RBA maintained its benchmark interest rates steady at 2.5%, for the 16th consecutive month, in line with market expectations.

Additionally, the RBA Governor, Glenn Stevens mentioned that the central bank expects the nation’s economic growth to be below trend for the next several quarters and further indicated that that rates would likely be held steady for some more time to support growth in the post-mining boom economy, as the “over-valued” Aussie continues to hamper the nation’s economic progress.

Early morning data indicated that, building approvals in Australia rebounded 11.4% on a monthly basis in October, higher than market expectations for a 5.0% gain and compared to a revised drop of 11.2% registered in the previous month. Meanwhile, the nation’s current account surplus unexpectedly widened to A$12.5 billion in 3Q 2014, following a deficit of A$13.9 billion, while markets were expecting a current account deficit of A$13.5 billion.

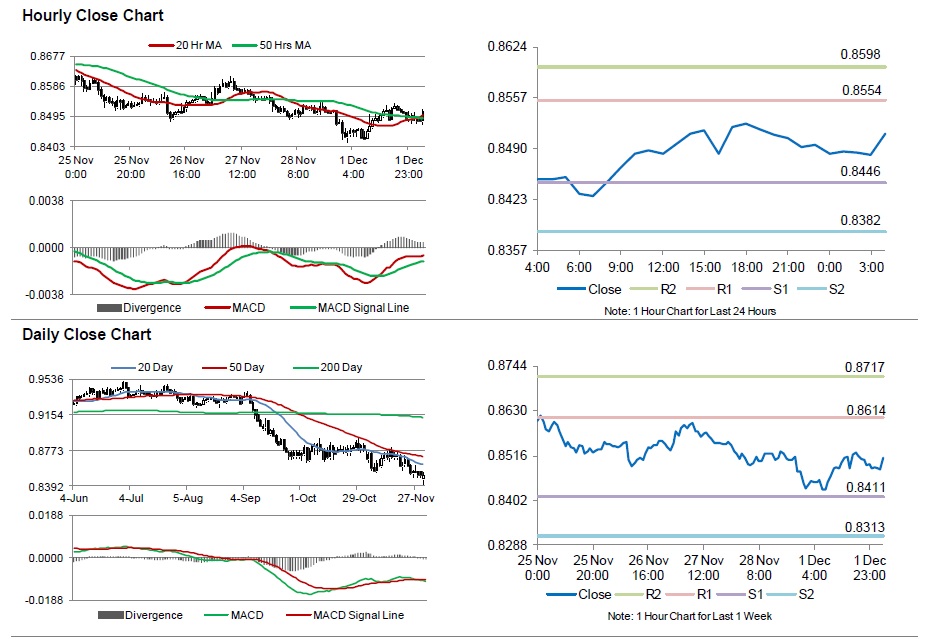

The pair is expected to find support at 0.8446, and a fall through could take it to the next support level of 0.8382. The pair is expected to find its first resistance at 0.8554, and a rise through could take it to the next resistance level of 0.8598.

Looking ahead, market participants await Australia’s crucial Q3 GDP data, scheduled in the early hours tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.