Gold prices traded lower by 2.31% against the USD in the 24 hour period ending 23:00GMT, at 1308.50 per ounce, thereby reporting its largest daily drop of 2014, following a rally in global equity markets and amid profit taking. Adding to pressure was another leading broker report, which provided a bearish outlook on the prices of the yellow metal.

Yesterday, the holdings in the SPDR Gold Trust, the world’s largest gold-backed

exchange-traded fund climbed 8.68 tonnes to 808.73 tonnes, the biggest increase since October 2012.

In the Asian session, at GMT0300, Gold is trading at 1307.9, marginally lower from yesterday’s close, ahead of the congressional testimony by the Federal Reserve Chairwoman, Janet Yellen, which is scheduled later during the day.

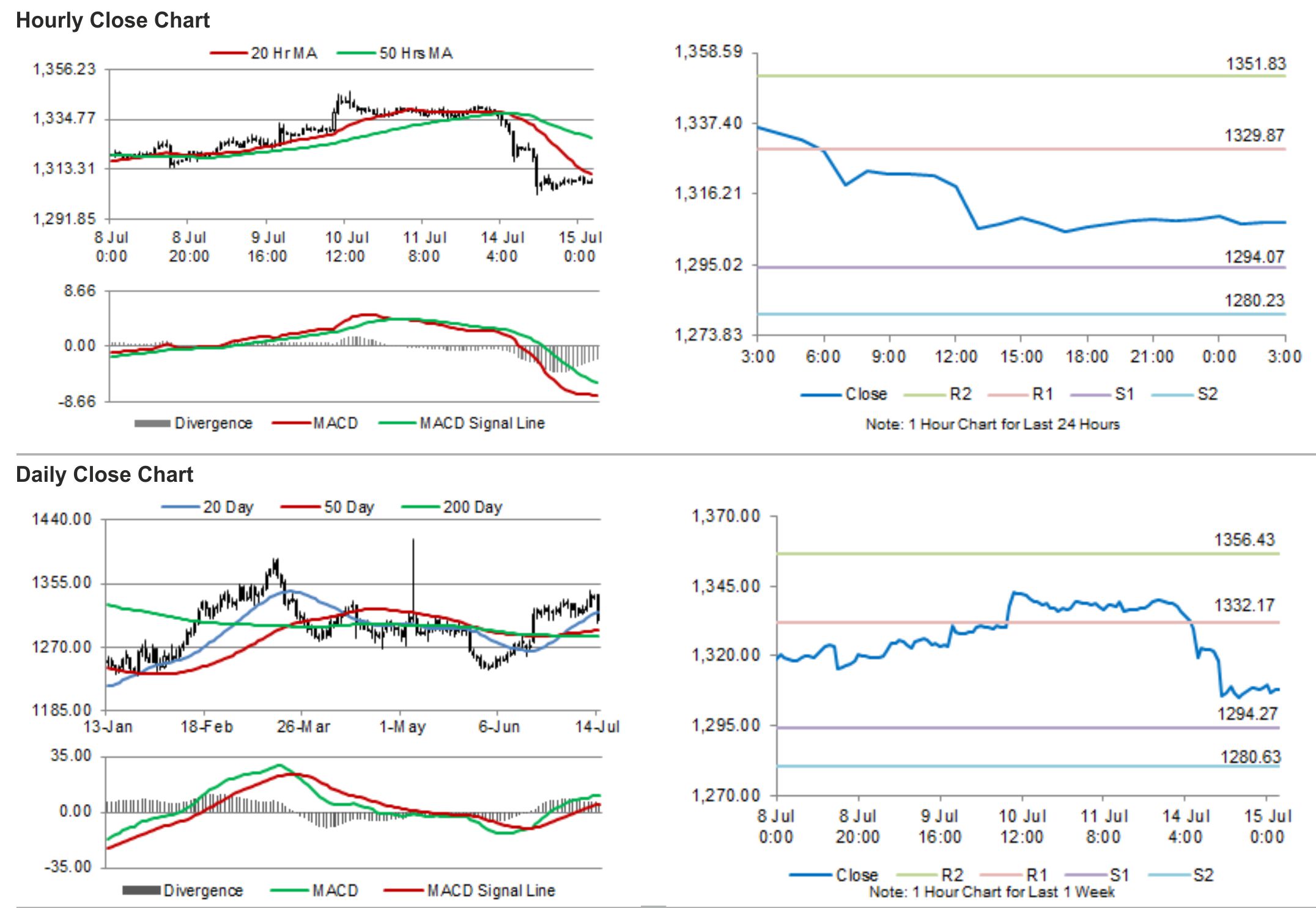

Gold is expected to find support at 1294.07, and a fall through could take it to the next support level of 1280.23. Gold is expected to find its first resistance at 1329.87, and a rise through could take it to the next resistance level of 1351.83.

The yellow metal is trading below its 20 Hr and 50 Hr moving averages.