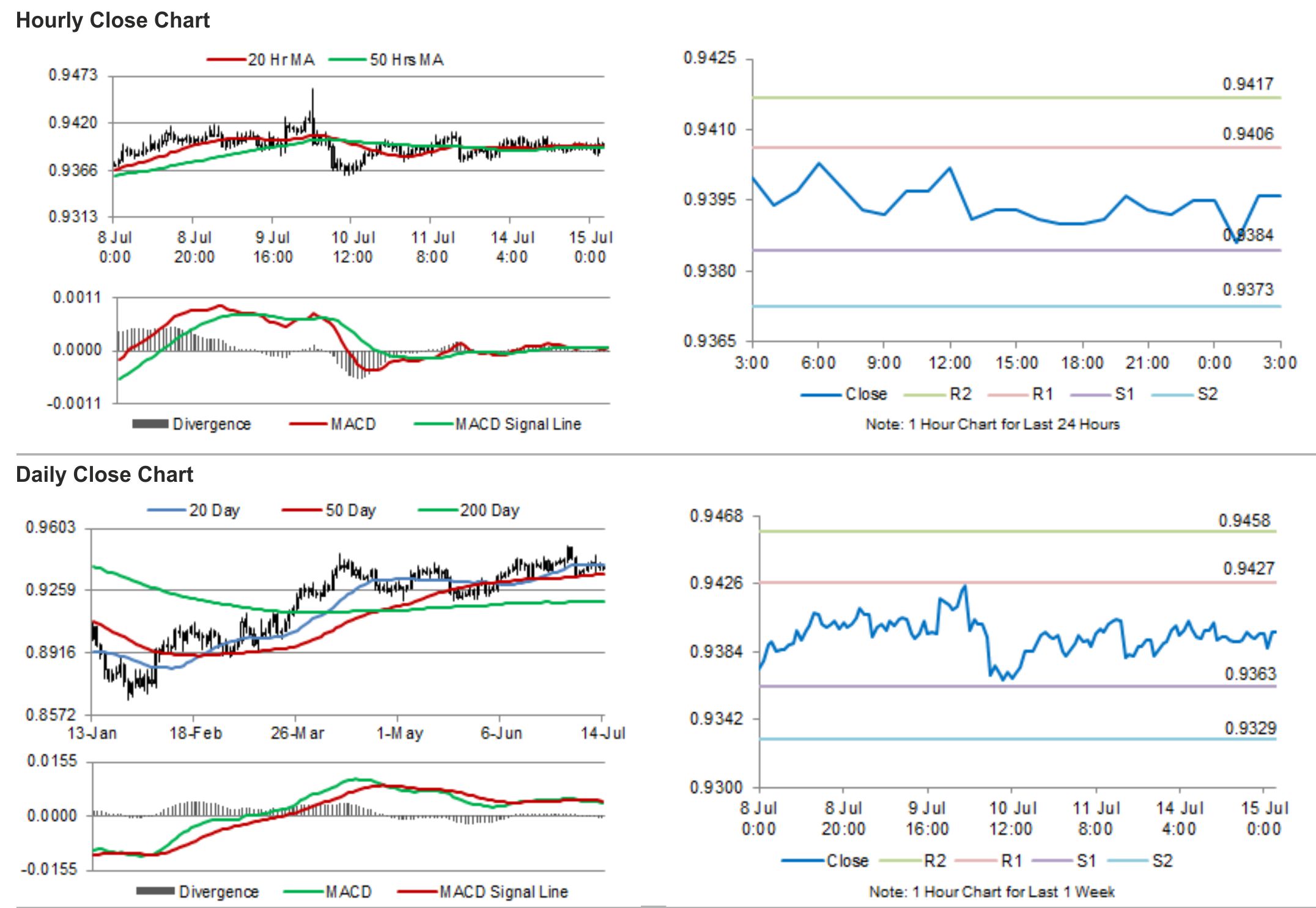

For the 24 hours to 23:00 GMT, the AUD strengthened 0.11% against the USD to close at 0.9395.

LME Copper prices marginally rose or $3.5/MT to $ 7154.5/MT. Aluminium prices rose 0.9% or $ 16.5/MT to $ 1923.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.9396, with the AUD trading tad higher from yesterday’s close.

The RBA in its minutes of its latest monetary policy meeting voiced its concerns on the strength of the Australian Dollar, particularly due to drop in commodity prices. The minutes further indicated that the overvalued Aussie was not helping the nation in achieving balanced growth. The central bank lowered its projections for the economic growth of the nation for the next 12 months, citing a decline in mining investment and weak public demand as well.

Earlier today, economic news revealed that the seasonally adjusted new motor vehicle sales registered a rise of 1.7% in June on a monthly basis, as compared to a revised increase of 0.4% in the prior month.

Meanwhile, macro data out of China, Australia’s largest trade partner indicated that the Chinese financial institutions reported a more than expected rise in its issue of loans. Additionally, the actual FDI in China, Australia’s largest trading partner, also surprisingly increased in June, while the foreign exchange reserves surplus in the nation expanded to $3.99 trillion in Q2 2014.

The pair is expected to find support at 0.9384, and a fall through could take it to the next support level of 0.9373. The pair is expected to find its first resistance at 0.9406, and a rise through could take it to the next resistance level of 0.9417.

With no major economic releases in Australia, trading trends in the pair today are expected to be determined by external factors.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.