For the 24 hours to 23:00 GMT, AUD weakened 2.61% against the USD to close at 1.0146, as concerns over the slowing global growth dented investor sentiment.

This morning, in Australia, the value of housing loans extended to owner-occupied homes, on a seasonally adjusted basis, came in unchanged at A$14.1 billion in June, while the National Australia Bank indicated that the business conditions index stood at -1.0 in July, compared to 2.0 in June. Also the business confidence index rose to 2.0 in July, compared to a reading of zero recorded in June

In the Asian session at 3:00GMT, the pair is trading at 1.0020, 1.24% lower from yesterday’s close at 23:00 GMT.

LME Copper prices declined 1.6% or $151.0/MT to $9,038.5/ MT. Aluminium prices declined 0.9% or $22.8/MT to $2,404.8/ MT.

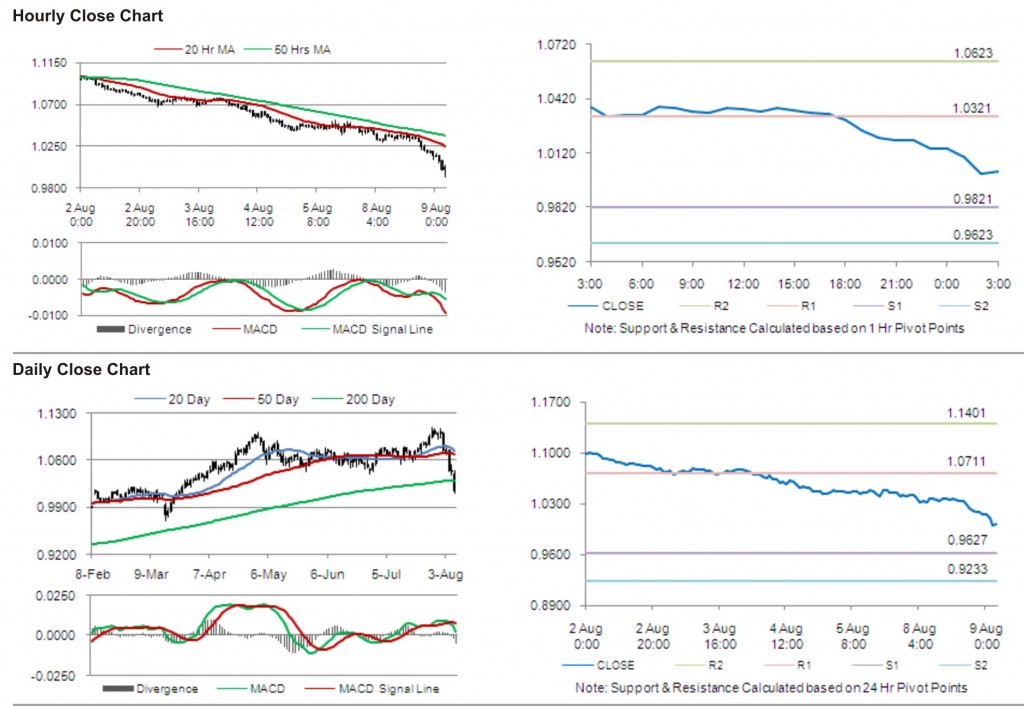

The pair is expected to find first short term resistance at 1.0321, with the next resistance levels at 1.0623 and 1.1123, subsequently. The first support for the pair is seen at 0.9821, followed by next supports at 0.9623 and 0.9123 respectively.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.