For the 24 hours to 23:00 GMT, USD declined 0.91% against the CHF and closed at 0.7542, as worries over the impact of Standard & Poor’s decision to downgrade US long-term debt boosted the demand for Swiss franc as a safe haven.

After an emergency meeting on Monday, the Swiss government has pledged action to reduce the value of the franc, saying that “energetic intervention” was required.

In the economic news, unemployment rate in Switzerland remained unchanged at 2.8% in July.

In the Asian session, at 3:00GMT, the pair is trading at 0.7498, 0.58% lower from yesterday’s close at 23:00 GMT.

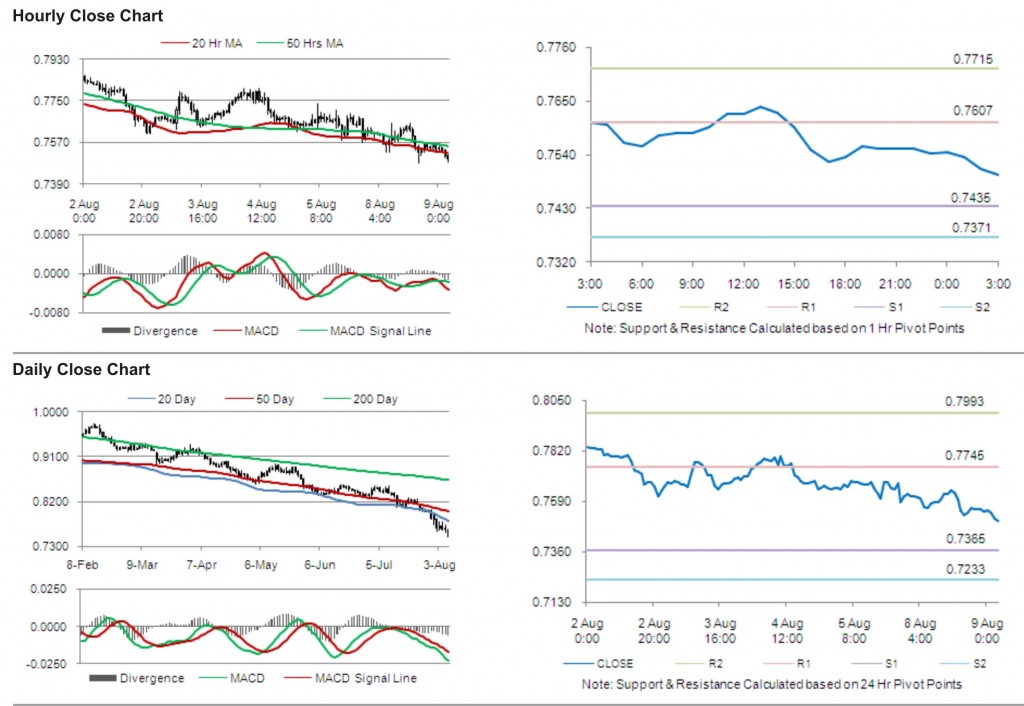

The pair has its first short term resistance at 0.7607, followed by the next resistance at 0.7715. The first area of support is at 0.7435 level, with the subsequent support at 0.7371.

Trading trends in the pair today are expected to be determined by release of data on consumer climate in Switzerland.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.