For the 24 hours to 23:00 GMT, AUD strengthened marginally against the USD, on Friday, to close at 1.1006,

In the morning news, the manufacturing activity index in Australia declined to 43.4 in July from 52.9 in June. Additionally, this morning, the new home sales declined 8.7% in June following a 0.2% decline in the previous month.

In the Asian session at 3:00GMT, the pair is trading at 1.1040, 0.31% higher from Friday’s close at 23:00 GMT.

AUD received strong support in the morning, after the announcement that the US politicians have reached an agreement to raise the debt ceiling, spurred demand for higher-yielding assets.

LME Copper prices declined 0.1% or $13.3/MT to $9,730.5/ MT. Aluminium prices declined 0.7% or $19.5/MT to $2,581.0/ MT.

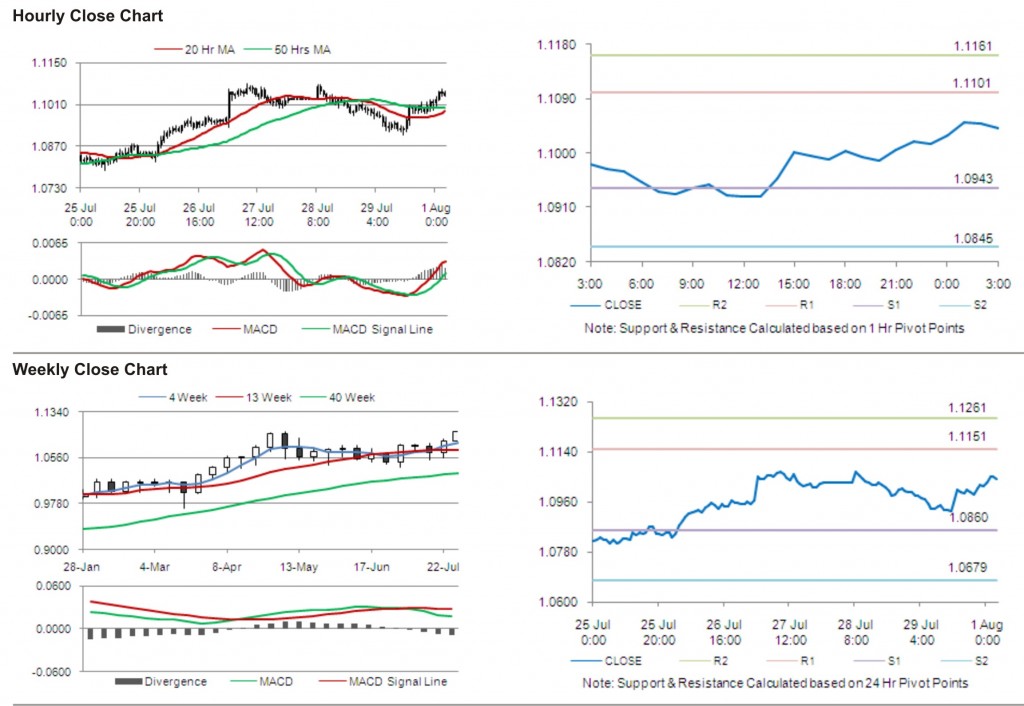

The pair is expected to find first short term resistance at 1.1101, with the next resistance levels at 1.1161 and 1.1319, subsequently. The first support for the pair is seen at 1.0943, followed by next supports at 1.0845 and 1.0687 respectively.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.