For the 24 hours to 23:00 GMT, EUR declined 0.77% against the USD and closed at 1.4259, amid lingering concerns about economic recovery and sovereign debt problems.

In the economic news, the manufacturing Purchasing Managers Index (PMI) in the Euro zone stood at 50.4 in July, following a reading of 52.0 on the previous month. The unemployment remained unchanged at 9.9% in June in line with market estimates.

Additionally, in Germany, the seasonally adjusted manufacturing Purchasing Managers Index (PMI) stood at 52.0 in July, compared to a reading of 54.6 in the previous month.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4267, marginally higher from the levels yesterday at 23:00GMT.

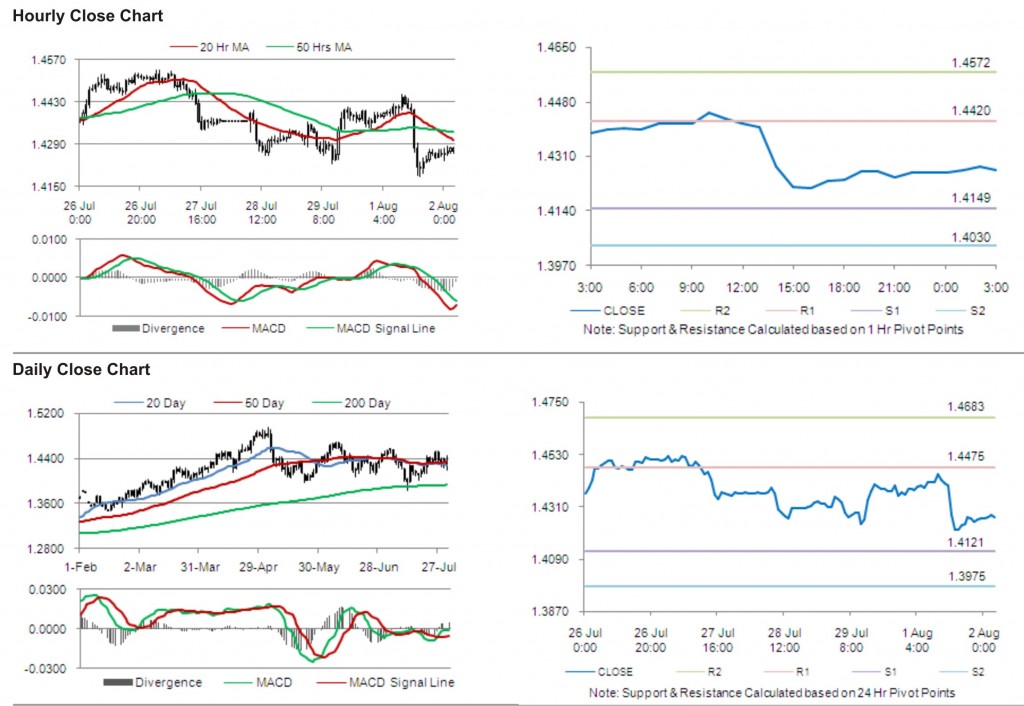

The pair has its first short term resistance at 1.4420, followed by the next resistance at 1.4572. The first support is at 1.4149, with the subsequent support at 1.4030.

Trading trends in the pair today are expected to be determined by release of producer price index in the Euro zone.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.