For the 24 hours to 23:00 GMT, AUD weakened 0.45% against the USD to close at 1.0691, after the Reserve Bank of Australia (RBA) left its key interest rates unchanged and stated that growth for this year is unlikely to match earlier forecasts.

The Reserve Bank yesterday kept interest rates on hold at 4.75% for the seventh consecutive board meeting. The RBA governor, Glenn Stevens signalled that the bank would lower its forecast for growth in its quarterly monetary policy statement next month.

In the Asian session at 3:00GMT, the pair is trading at 1.0726, 0.33% higher from yesterday’s close at 23:00 GMT.

LME Copper prices declined 0.1% or $5.3/MT to $9,405.3/ MT. Aluminium prices rose 1.0% or $25.0/MT to $2,485.3/ MT.

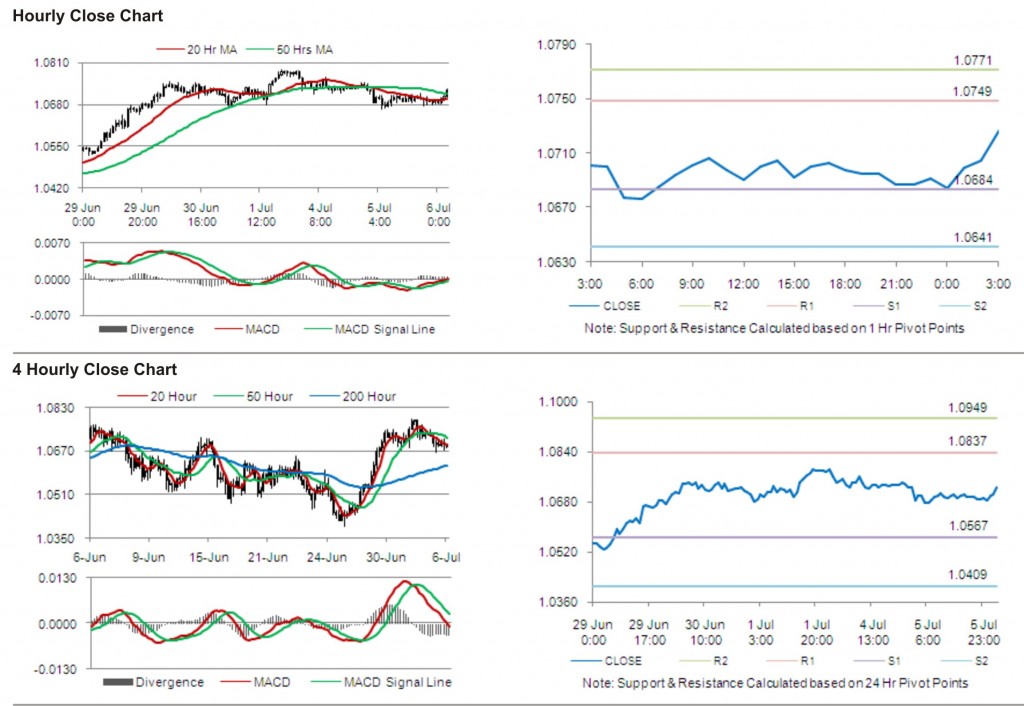

The pair is expected to find first short term resistance at 1.0749, with the next resistance levels at 1.0771 and 1.0836, subsequently. The first support for the pair is seen at 1.0684, followed by next supports at 1.0641 and 1.0576 respectively.

Trading trends in the pair today are expected to be determined by data release on AiG performance of construction index in Australia.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.