For the 24 hours to 23:00 GMT, GBP fell 0.09% against the USD and closed at 1.6067.

Pound came under pressure, yesterday, after Barclays Capital revised down its forecast for the British pound, citing disappointing economic data.

In the UK, the services purchasing managers index rose to 53.9 in June compared to a reading of 53.8 in May. Additionally, the British Retail Consortium (BRC) indicated that the shop price inflation rose to 2.9% (M-o-M) in June, following a rate of 2.3% recorded in May.

The pair opened the Asian session at 1.6067, and is trading at 1.6081 at 3.00GMT. The pair is trading 0.09% higher from yesterday’s close at 23:00 GMT.

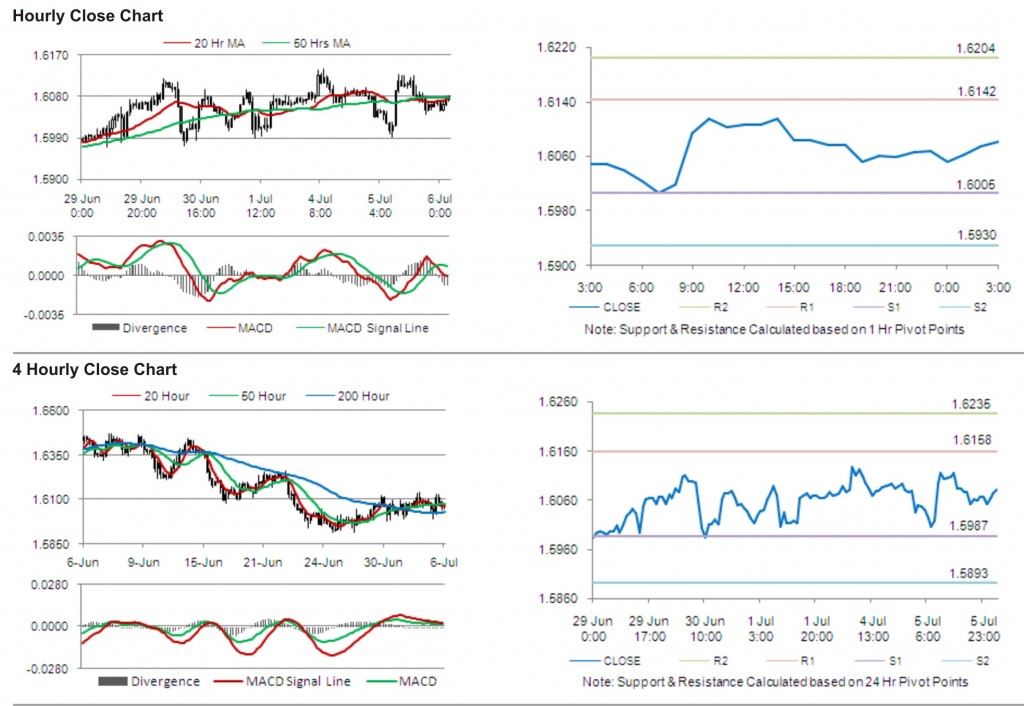

The pair has its first short term resistance at 1.6142, followed by the next resistance at 1.6204. The first support is at 1.6005, with the subsequent support at 1.5930.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving averages.