For the 24 hours to 23:00 GMT, the AUD weakened 0.96% against the USD to close at 0.8532. Yesterday, the RBA, Deputy Governor, warned that the “Aussie” has persistently remained at unusually high levels and is set to fall further following declining commodity prices and business investment. He further stated that elevated prices have raised the nation’s business costs, thereby slowing economic growth.

Separately, the OECD, in its semi-annual economic outlook, forecasted that the Australian economy would grow at a below average rate of 2.5% in 2015 but would pick up and expand close to 3% in 2016. Furthermore, the agency urged the RBA to start hiking its key interest rates next year to stop rising house prices in Australia.

LME Copper prices declined 0.52% or $35.0/MT to $6696.0/MT. Aluminium prices rose 1.17% or $24.0/MT to $2084.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8540, with the AUD trading 0.09% higher from yesterday’s close.

Earlier today, data from Australia indicated that the construction work done recorded a drop of 2.2% on a seasonally adjusted and quarterly basis, higher than market expectations for a fall of 1.9% and compared to a decline of 1.2% in the prior quarter.

Elsewhere in China, Australia’s biggest trading partner, data showed that the nation’s Westpac MNI consumer sentiment index edged down to 110.0 in November, compared to a level of 110.9 registered in the previous month.

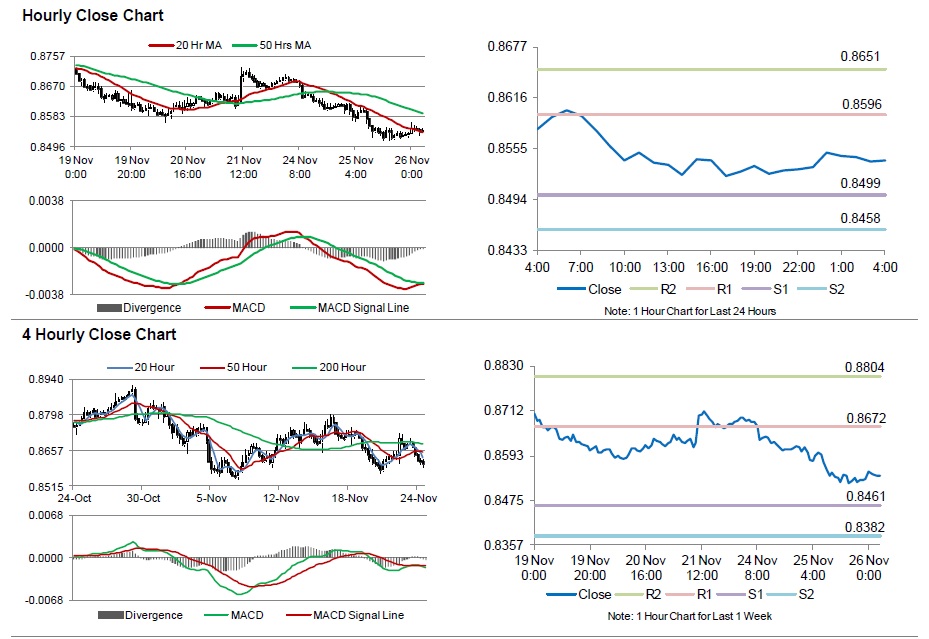

The pair is expected to find support at 0.8499, and a fall through could take it to the next support level of 0.8458. The pair is expected to find its first resistance at 0.8596, and a rise through could take it to the next resistance level of 0.8651.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.