For the 24 hours to 23:00 GMT, the USD declined 0.26% against the CAD to close at 1.1257.

The CAD gained ground, after Canada’s retail sales rebounded more-than-expected 0.8% on a monthly basis in September, marking its first rise in 3-months and following a 0.2% drop registered in the prior month. Markets were expecting it to rise 0.5%.

Separately, the Organization for Economic Co-operation and Development (OECD) slashed its economic growth forecast for the Canadian economy to 2.4% in 2014 from 2.5% and 2.6% in 2015 from 2.7%, compared to its earlier estimations. It further indicated that the BoC would start raising its interest rates in May 2015.

In the Asian session, at GMT0400, the pair is trading at 1.1263, with the USD trading 0.06% higher from yesterday’s close.

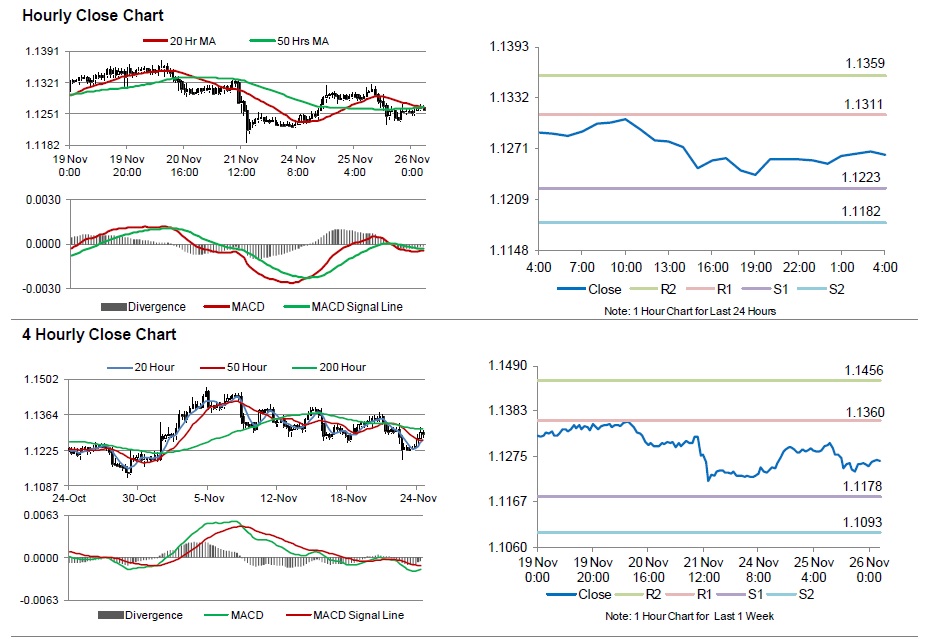

The pair is expected to find support at 1.1223, and a fall through could take it to the next support level of 1.1182. The pair is expected to find its first resistance at 1.1311, and a rise through could take it to the next resistance level of 1.1359.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.