On Friday, the AUD traded marginally higher against the USD to close at 0.9319.

LME Copper prices declined 0.5% or $ 34.0/MT to $ 6852.5/MT. Aluminium prices declined 1.2% or $ 25.0/MT to $ 1980.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.9319, with the AUD trading flat from Friday’s close.

Data released this morning, indicated that the seasonally adjusted new motor vehicle sales in Australia, eased 0.4% on an annual basis, in July. It had recorded a drop of 2.0% in the previous month. Meanwhile, in China, Australia’s biggest trading partner, the MNI business sentiment index advanced to 59.0 in August, compared to a reading of 58.2, a month ago. On the other hand, the foreign direct investment in China in the January-July period fell 0.35% on year to $71.14 billion.

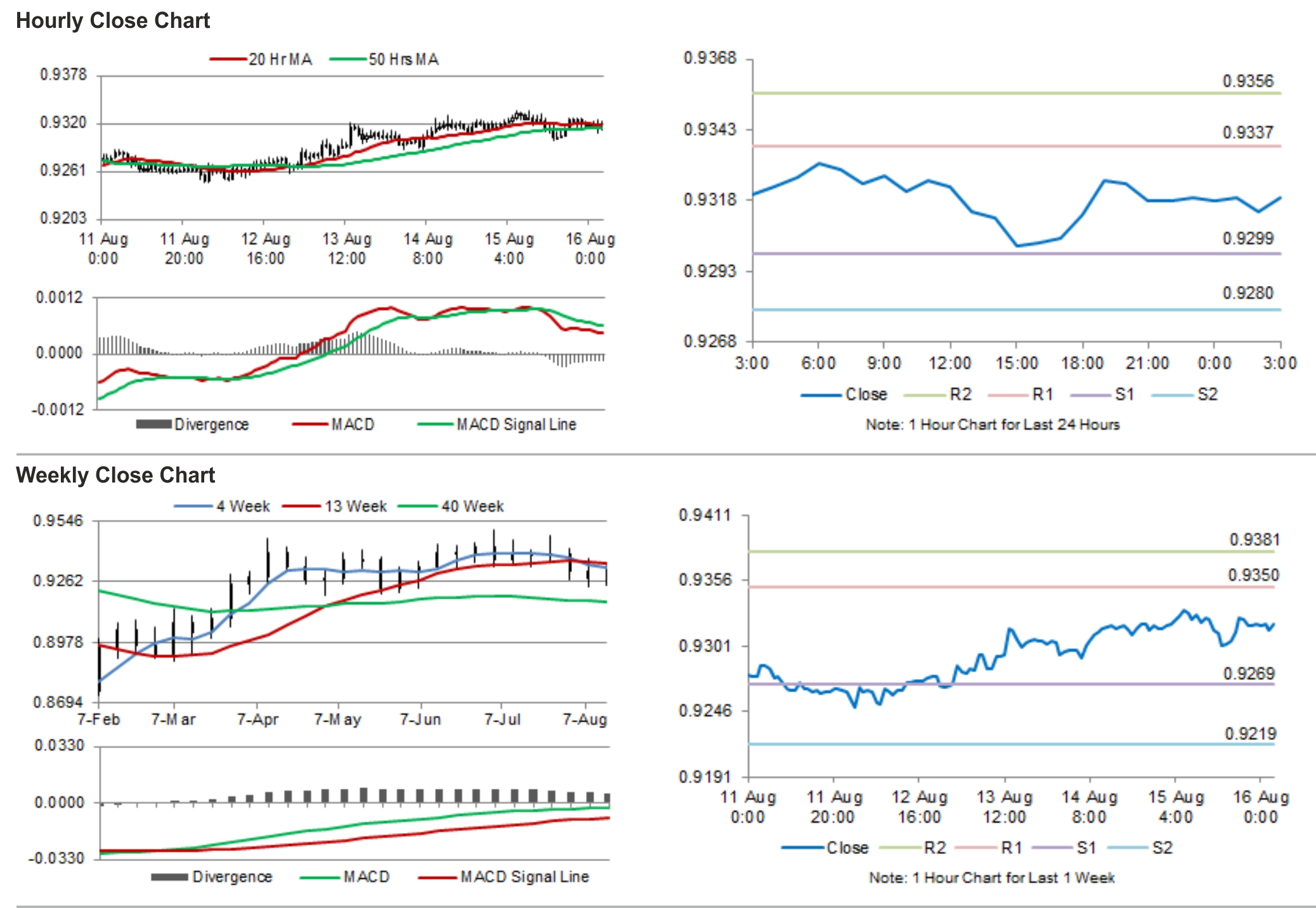

The pair is expected to find support at 0.9299, and a fall through could take it to the next support level of 0.928. The pair is expected to find its first resistance at 0.9337, and a rise through could take it to the next resistance level of 0.9356.

Amid lack of economic releases from Australia today, investors would keenly await tomorrow’s minutes of the latest RBA policy meeting.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.