On Friday, the USD declined 0.11% against the CAD to close at 1.0894, following upbeat labour data from Canada. The unemployment rate in Canada unexpectedly dropped to a level of 7.0% in July, lower than market estimations for a reading of 7.1%. In the previous month, the unemployment rate had recorded a reading of 7.1%. Additionally, the Canadian economy added 41.7K jobs in July, almost twice the market expectations. Similarly, the July existing home sales in Canada advanced 0.8%, on monthly basis. Moreover, the Canadian manufacturing sales rose 0.6% in June, on a monthly basis, more than market expectations for a rise of 0.4% and following a 1.7% increase in May.

In the Asian session, at GMT0300, the pair is trading at 1.0882, with the USD trading 0.11% lower from Friday’s close.

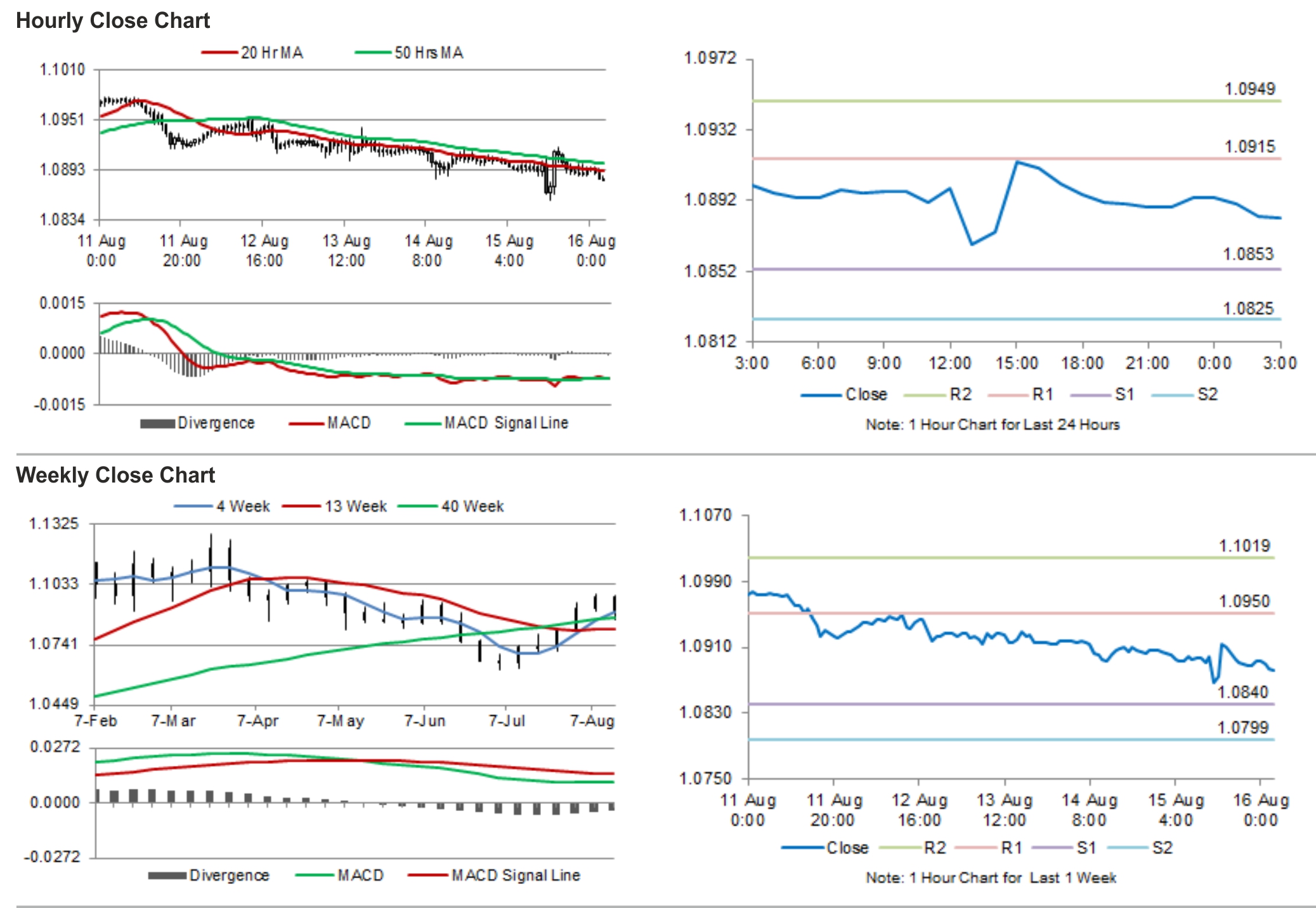

The pair is expected to find support at 1.0853, and a fall through could take it to the next support level of 1.0825. The pair is expected to find its first resistance at 1.0915, and a rise through could take it to the next resistance level of 1.0949.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.