For the 24 hours to 23:00 GMT, the AUD weakened 0.53% against the USD to close at 0.7145.

LME Copper prices rose 0.32% or $16.5/MT to $5165.5/MT. Aluminium prices rose 0.17% or $2.5/MT to $1472.5/MT.

Yesterday, the RBA Governor, Glenn Stevens, stated that the central bank’s next official interest rate move will “almost certainly” be a cut due to Australia’s low inflation and a potentially cooling housing market. He further stated that economic growth in China, Australia’s largest trading partner, was uncertain and presented a challenge for Australian miners.

In the Asian session, at GMT0400, the pair is trading at 0.7155, with the AUD trading 0.14% higher from yesterday’s close.

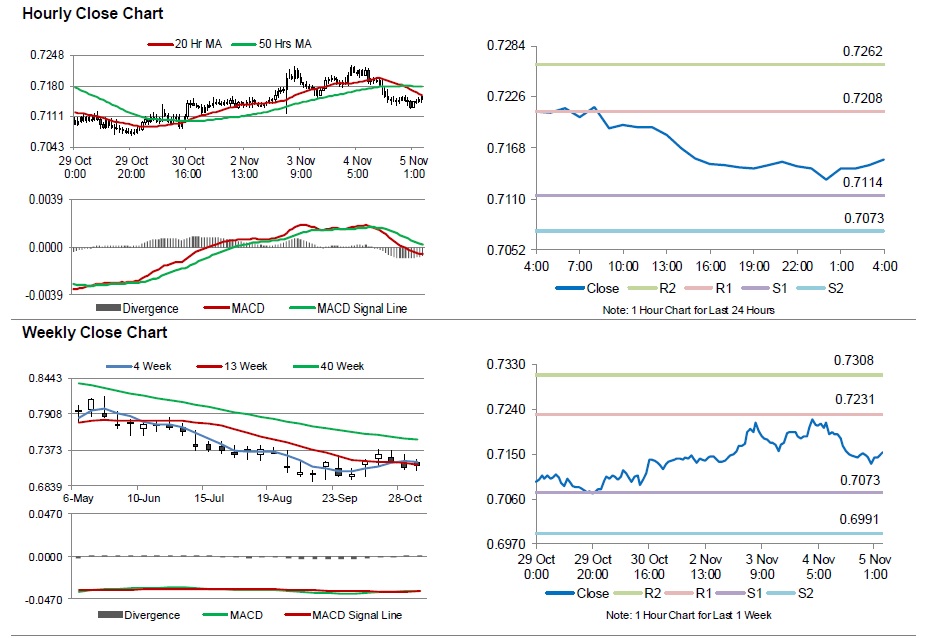

The pair is expected to find support at 0.7114, and a fall through could take it to the next support level of 0.7073. The pair is expected to find its first resistance at 0.7208, and a rise through could take it to the next resistance level of 0.7262.

Going ahead, market participants will look forward to Australia’s AiG performance of construction index for October, scheduled to be released later today. Moreover, investors will closely watch the RBA’s monetary policy statement, scheduled overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.