For the 24 hours to 23:00 GMT, the USD rose 0.65% against the CAD to close at 1.3150.

In economic news, Canada’s international merchandise trade deficit narrowed more than market forecasts to C$1.7 billion in September, mainly led by a rise in export of consumer goods, from a downwardly revised trade deficit of C$2.7 billion in the previous month.

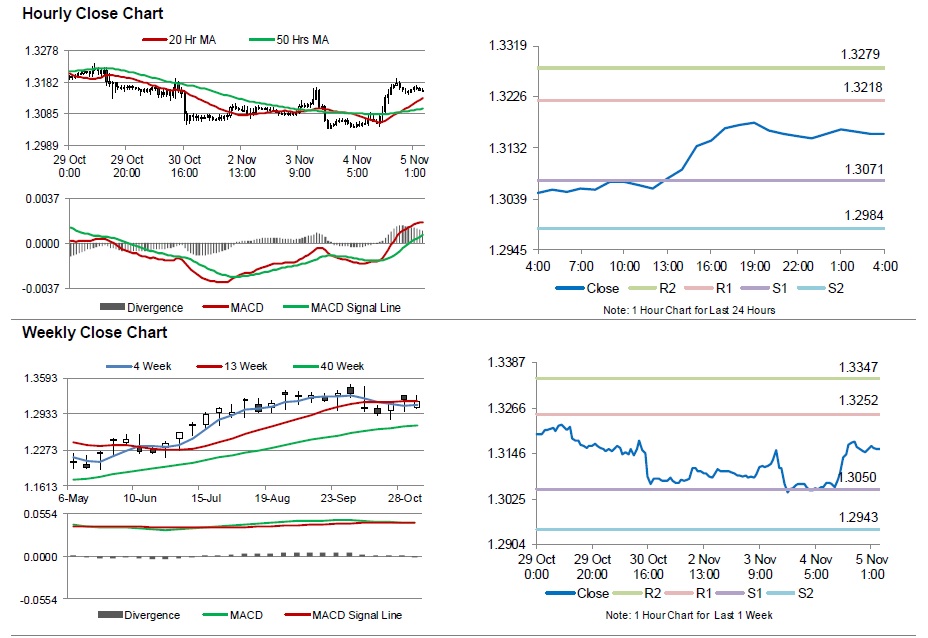

In the Asian session, at GMT0400, the pair is trading at 1.3157, with the USD trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.3071, and a fall through could take it to the next support level of 1.2984. The pair is expected to find its first resistance at 1.3218, and a rise through could take it to the next resistance level of 1.3279.

Going forward, investors will concentrate on Canada’s Ivey PMI data for October, scheduled to be released later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.