For the 24 hours to 23:00 GMT, the AUD weakened 0.82% against the USD to close at 0.7317.

LME Copper prices declined 1.47% or $70.5/MT to $4739.5/MT. Aluminium prices declined 2.66% or $42.5/MT to $1556.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7331, with the AUD trading 0.19% higher from yesterday’s close.

Early this morning, in China, Australia’s largest trading partner, data showed that consumer price index rose in line with investor expectations by 2.3% YoY in April, compared to a similar rise in the prior month. Additionally, the nation’s producer price index fell less-than-expected by 3.4% YoY in April, compared to a fall of 4.3% in the prior month. Market anticipation was for the producer price index to fall 3.7%.

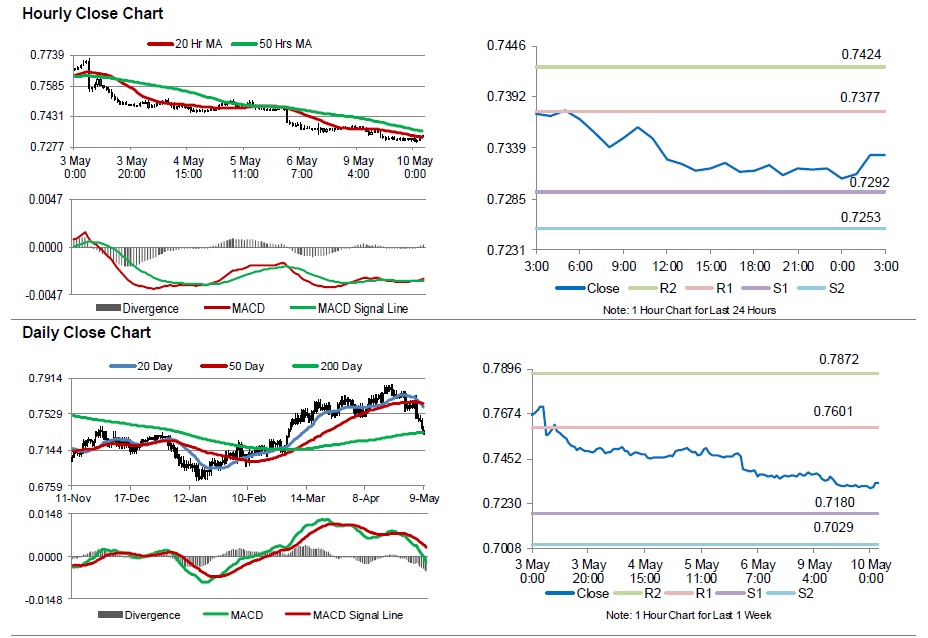

The pair is expected to find support at 0.7292, and a fall through could take it to the next support level of 0.7253. The pair is expected to find its first resistance at 0.7377, and a rise through could take it to the next resistance level of 0.7424.

Going ahead, investors will look forward to the release of Australia’s Westpac consumer confidence index and home loans data, due in the early hours tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.