For the 24 hours to 23:00 GMT, the USD rose 0.24% against the CAD to close at 1.2958.

In economic news, Canada’s seasonally adjusted housing starts fell to a 3-month low level of 191.5K in April, compared to a revised reading of 202.4K in the previous month. Markets were expecting housing starts to ease to a level of 193.0K.

Separately, the International Monetary Fund (IMF) indicated that Canada’s economy has coped well with the decline in oil prices, but the Bank of Canada (BoC) should be ready to cut interest rates again if growth falters. Further, the IMF forecasted the nation to grow by 1.7% this year and by 2.2% in 2017.

In the Asian session, at GMT0300, the pair is trading at 1.2967, with the USD trading 0.07% higher from yesterday’s close.

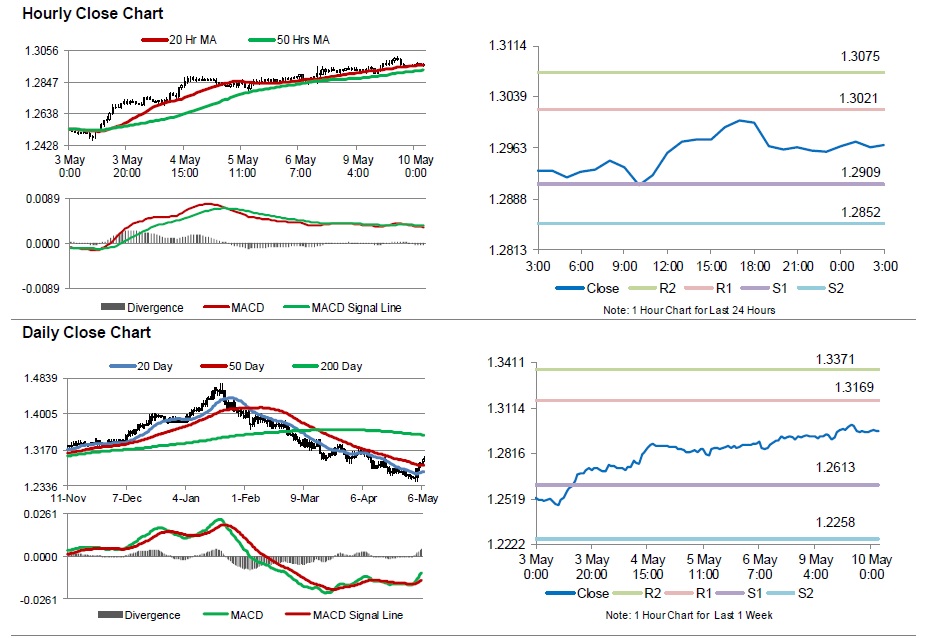

The pair is expected to find support at 1.2909, and a fall through could take it to the next support level of 1.2852. The pair is expected to find its first resistance at 1.3021, and a rise through could take it to the next resistance level of 1.3075.

With no economic releases in Canada today, investor sentiment would be governed by global macroeconomic news.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.