For the 24 hours to 23:00 GMT, AUD strengthened 0.34% against the USD to close at 0.9030, on positive reaction to Australia’s upbeat employment data. However, the latest batch of soft economic releases from China, Australia’s largest trading partner, capped the gains in the Aussie.

LME Copper prices declined marginally by $3.0/MT to $6495.0/MT. Aluminium prices fell 0.8% or $13.5/MT to $1703.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.9020, with the AUD trading 0.11% lower from yesterday’s close. Earlier today, one of the leading broking firms downgraded its 12-month forecast for the Aussie to 80 cents from 85 cents and six-months estimate to 82 cents from 88 cents, citing the possibility for the RBA to slash its key interest rate in the future.

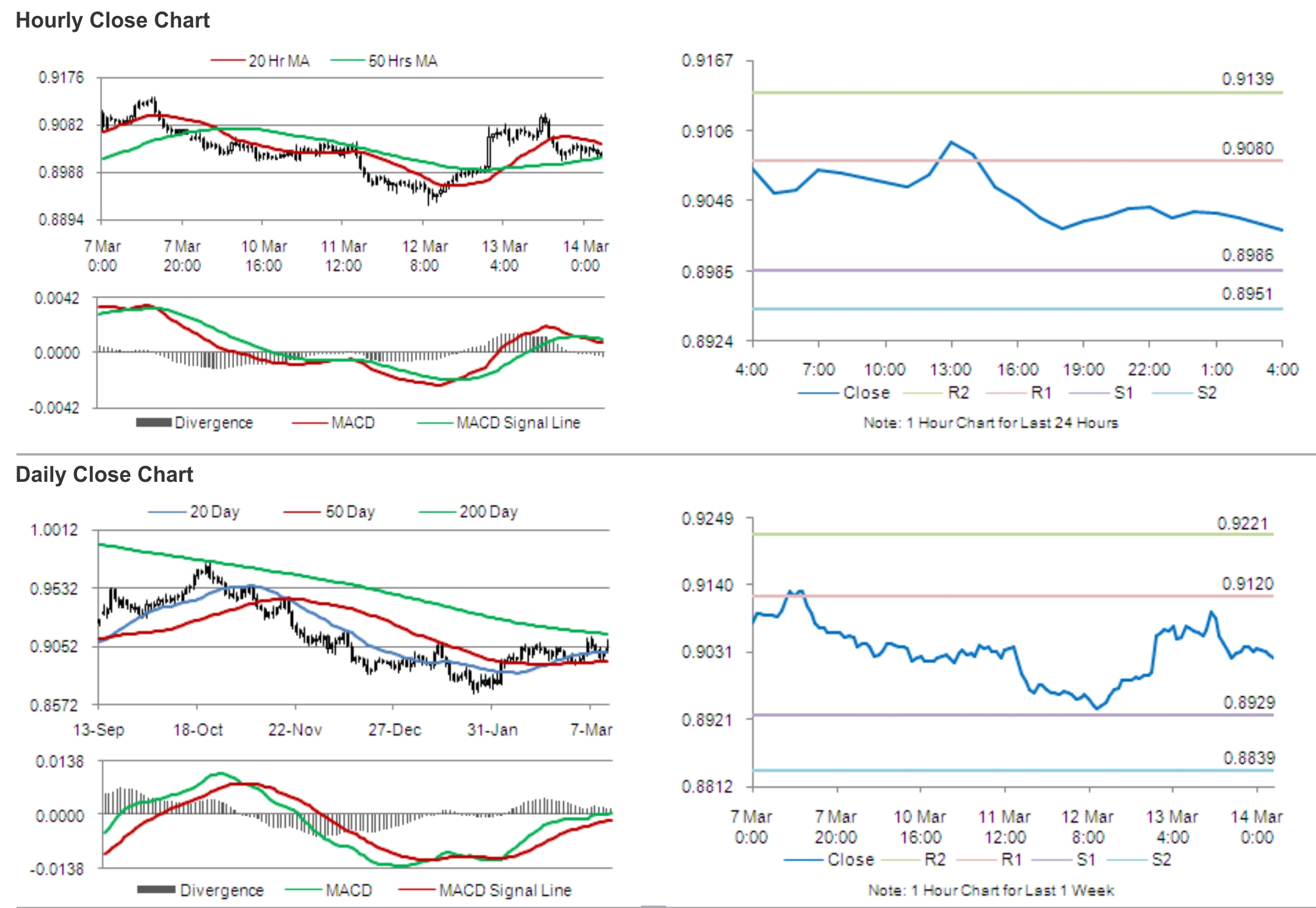

The pair is expected to find support at 0.8986, and a fall through could take it to the next support level of 0.8951. The pair is expected to find its first resistance at 0.9080, and a rise through could take it to the next resistance level of 0.9139.

The currency pair is trading below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.