For the 24 hours to 23:00 GMT, the USD declined 0.36% against the CAD to close at 1.1079, despite data indicating that the retail sales in the US advanced in February for the first time in three months, while initial jobless claims unexpectedly declined last week.

The Canadian Dollar gained momentum after data revealed that the prices of new houses in Canada increased in January by the most since May 2012. Statistics Canada reported that the new housing price index rose more-than-expected 0.3% (MoM) in January, compared to a 0.1% increase recorded in the previous month. Separately, capital utilization in the nation advanced 82.0% fourth quarter, compared to a revised rate of 81.2% recorded in the preceding quarter.

In the Asian session, at GMT0400, the pair is trading at 1.1094, with the USD trading 0.14% higher from yesterday’s close.

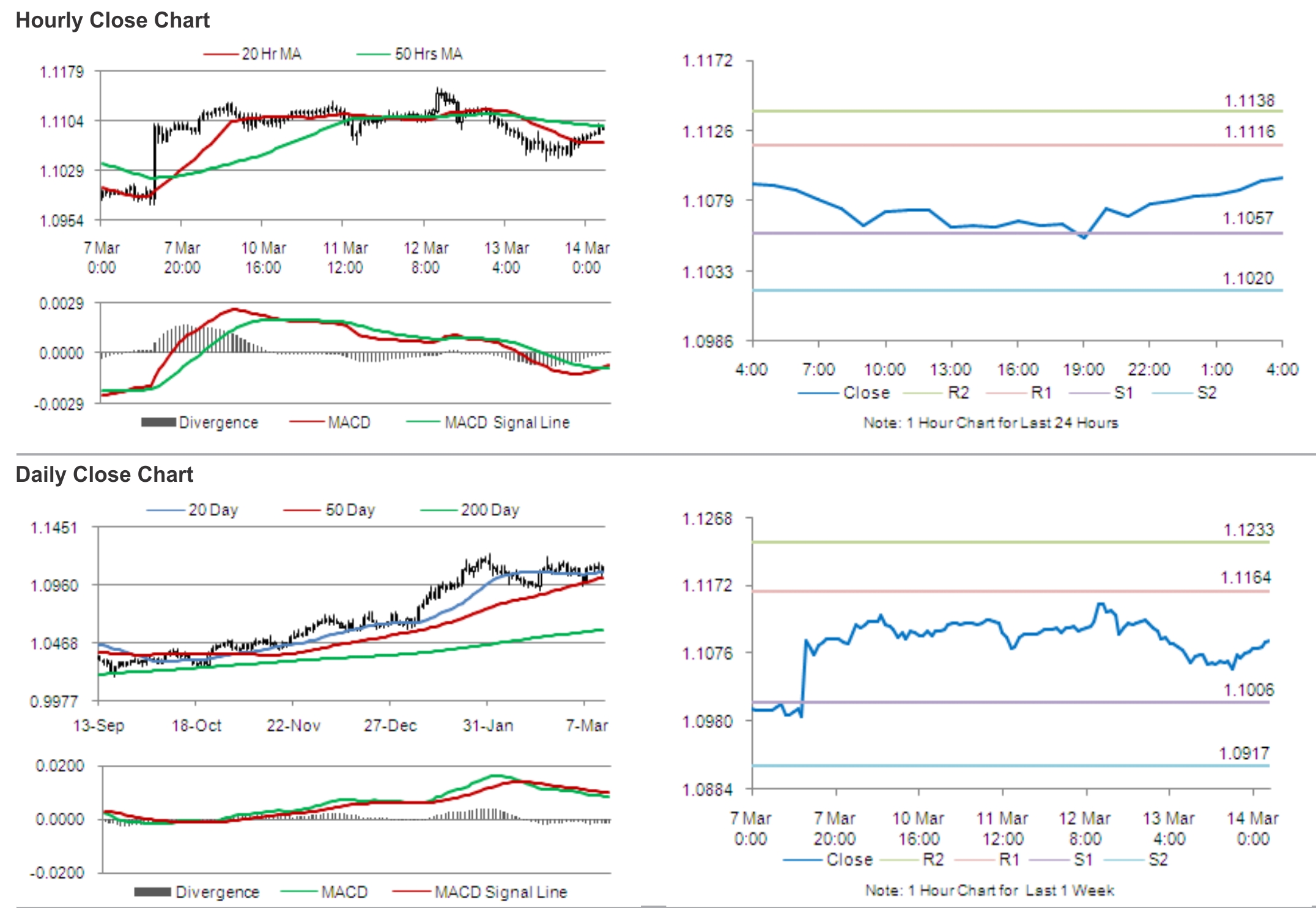

The pair is expected to find support at 1.1057, and a fall through could take it to the next support level of 1.1020. The pair is expected to find its first resistance at 1.1116, and a rise through could take it to the next resistance level of 1.1138.

Amid lack of economic releases from Canada during the later course of the day, traders would keep a tab on global economic news for further guidance in the pair.

The currency pair is trading above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.