For the 24 hours to 23:00 GMT, the AUD declined 0.49% against the USD and closed at 0.7788.

LME Copper prices declined 0.6% or $43.0/MT to $6830.0/MT. Aluminium prices declined 1.4% or $30.0/MT to $2082.5/MT.

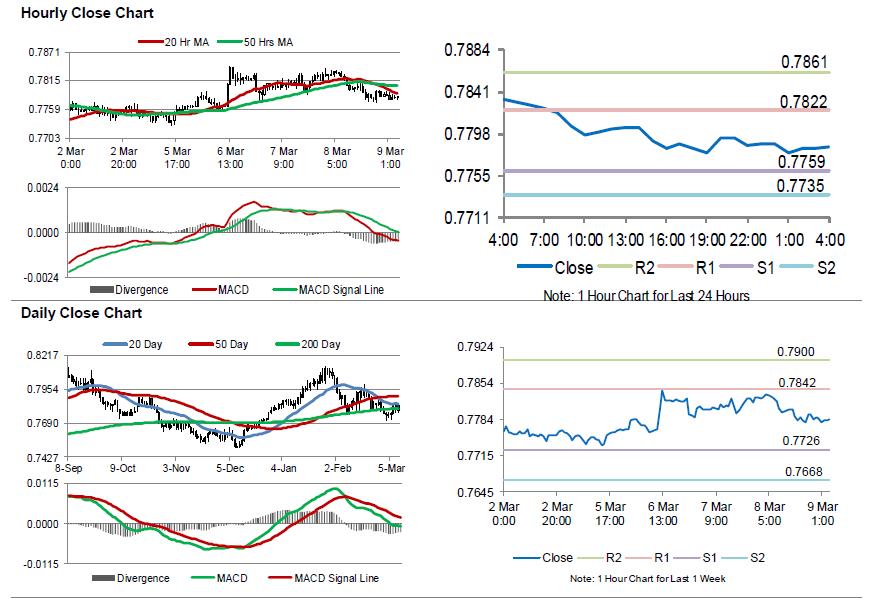

In the Asian session, at GMT0400, the pair is trading at 0.7784, with the AUD trading 0.1% lower against the USD from yesterday’s close.

Earlier today, in China, Australia’s largest trading partner, the consumer price index (CPI) grew 2.9% on an annual basis in February, beating market expectations for an advance of 2.5% and jumping to its strongest level since November 2013. The CPI had risen 1.5% in the prior month.

On the other hand, the nation’s producer price index (PPI) climbed 3.7% on a yearly basis in February, rising at its weakest pace in 15 months and undershooting market consensus for a rise of 3.8%. In the prior month, the PPI had advanced 4.3%.

The pair is expected to find support at 0.7759, and a fall through could take it to the next support level of 0.7735. The pair is expected to find its first resistance at 0.7822, and a rise through could take it to the next resistance level of 0.7861.

Next week, traders would look forward to Australia’s NAB business confidence, consumer inflation expectations and the Westpac consumer confidence index.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.