For the 24 hours to 23:00 GMT, the USD slightly rose against the CAD and closed at 1.2892.

Macroeconomic data showed that Canada’s seasonally adjusted housing starts surprisingly climbed to a level of 229.7K in February, defying market expectations for a drop to a level of 215.0K, amid a sharp rise in construction of new buildings. In the prior month, housing starts had recorded a revised level of 215.3K. Moreover, the nation’s building permits registered an unexpected rise of 5.6% on a monthly basis in January, posting the biggest increase in 8 months and confounding investor consensus for a fall of 1.5%. Building permits had recorded a revised rise of 2.5% in the prior month.

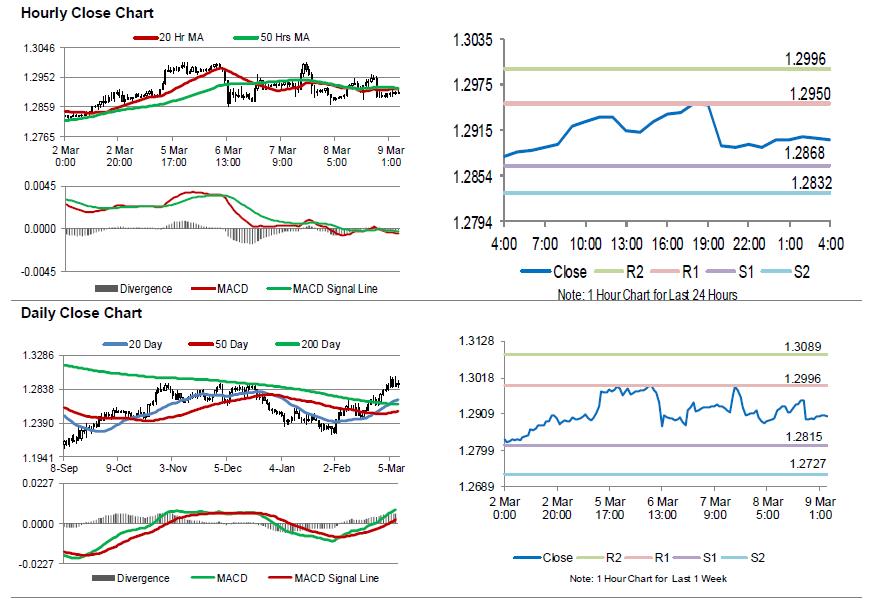

In the Asian session, at GMT0400, the pair is trading at 1.2903, with the USD trading 0.09% higher against the CAD from yesterday’s close.

The pair is expected to find support at 1.2868, and a fall through could take it to the next support level of 1.2832. The pair is expected to find its first resistance at 1.295, and a rise through could take it to the next resistance level of 1.2996.

Ahead in the day, market participants would draw their attention to Canada’s unemployment rate data for February.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.