For the 24 hours to 23:00 GMT, the AUD strengthened 1.02% against the USD to close at 0.8798.

LME Copper prices rose 0.01% or $0.5/MT to $6781.0/MT. Aluminium prices rose 0.18% or $3.5/MT to $1912.5/MT.

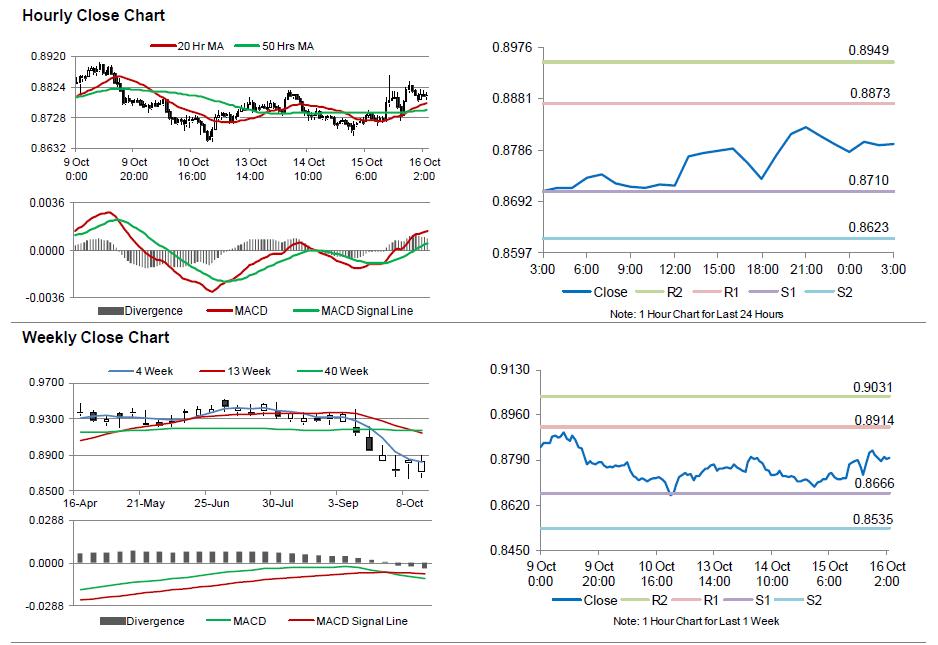

In the Asian session, at GMT0300, the pair is trading at 0.8797, with the AUD trading marginally lower from yesterday’s close.

Early morning data indicated that, consumer inflation expectation in Australia dropped to 3.4% in October, compared to an increase of 3.5% recorded in September. Meanwhile, the RBA reported that the nation’s foreign exchange transaction surplus rose to A$910.0 million in September, following a surplus of A$381.0 million in the prior month.

Elsewhere in China, Australia’s biggest trading partner, new Yuan loans rose to a level of CNY 857.2 billion in September, compared to CNY 702.5 registered in the prior month. Markets were anticipating new Yuan loans to climb to CNY 745.8 billion. Meanwhile, the nation’s actual FDI unexpectedly rose 1.9% on a YoY basis, more than market expectations for a fall of 14.0% and following a drop of 14.0% in the prior month.

The pair is expected to find support at 0.8710, and a fall through could take it to the next support level of 0.8623. The pair is expected to find its first resistance at 0.8873, and a rise through could take it to the next resistance level of 0.8949.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.