For the 24 hours to 23:00 GMT, the USD declined 0.31% against the CAD to close at 1.1267, after retail sales in the US deteriorated in September.

In economic news, Canada’s existing home sales eased 1.4% in September on a monthly basis, after registering a rise of 1.8% in the prior month.

A private survey revealed that Canadian house owners were taking advantage of record-low interest rates and paying down their mortgages at a faster than expected pace.

In the Asian session, at GMT0300, the pair is trading at 1.1259, with the USD trading 0.07% lower from yesterday’s close.

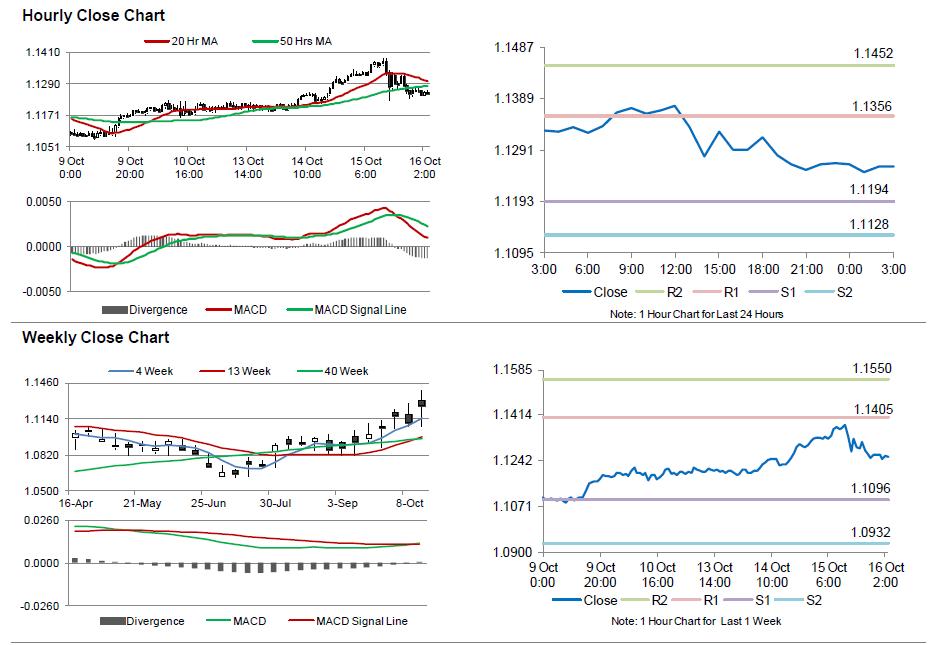

The pair is expected to find support at 1.1194, and a fall through could take it to the next support level of 1.1128. The pair is expected to find its first resistance at 1.1356, and a rise through could take it to the next resistance level of 1.1452.

Meanwhile, investors look forward to Canada’s consumer price index (CPI) data scheduled tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.