On Friday, the commodity linked AUD weakened 0.22% against the USD to close at 0.7788, as a broad strength in the greenback decreased the demand for the commodities as an alternative investment.

LME Copper prices rose 1.73% or $97.0/MT to $5692.0/MT. Aluminium prices rose 1.22% or $22.5/MT to $1871.5/MT.

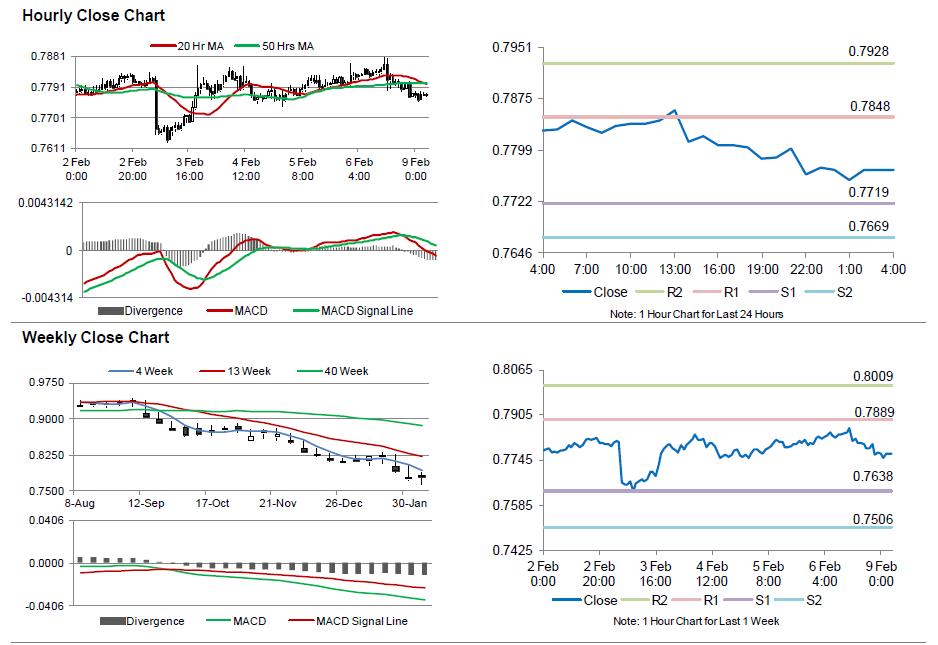

In the Asian session, at GMT0400, the pair is trading at 0.7769, with the AUD trading 0.25% lower from Friday’s close.

Early morning data showed that Australia’s ANZ job advertisements registered a rise of 1.3% on a monthly basis in January. It had climbed 1.8% in December.

Over the weekend, trade surplus of China (Australia’s biggest trading partner) surprisingly expanded to $60.03 billion in January, against market expectations to drop to $48.20 billion and compared to prior month’s level of $49.61 billion.

The pair is expected to find support at 0.7719, and a fall through could take it to the next support level of 0.7669. The pair is expected to find its first resistance at 0.7848, and a rise through could take it to the next resistance level of 0.7928.

Looking ahead, market participants await Australia’s jobless rate data, scheduled later in the week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.