On Friday, the USD rose 0.82% against the CAD to close at 1.2536, as the US registered upbeat non-farm payrolls figure in January.

On the macro front, Canada’s unemployment rate unexpectedly dropped to a level of 6.6% in January, following prior month’s reading of 6.7%. Markets were expecting the nation’s unemployment rate to remain unchanged at 6.7%.

In other economic news, building permits in Canada rebounded 7.7% on a MoM basis in December, beating market expectations for a 5.0% rise and compared to a revised drop of 13.6% registered in November.

In the Asian session, at GMT0400, the pair is trading at 1.2509, with the USD trading 0.21% lower from Friday’s close.

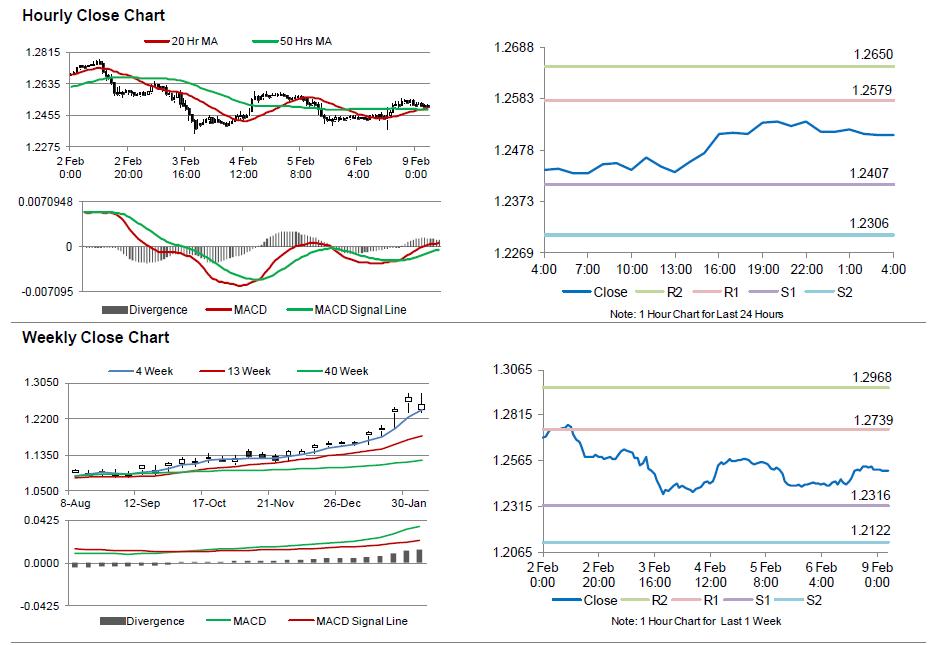

The pair is expected to find support at 1.2407, and a fall through could take it to the next support level of 1.2306. The pair is expected to find its first resistance at 1.2579, and a rise through could take it to the next resistance level of 1.2650.

Meanwhile, investors look forward to Canada’s housing starts data, scheduled later today.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.