For the 24 hours to 23:00 GMT, the AUD strengthened 1.14% against the USD to close at 0.7192.

Yesterday, the RBA’s Head of economic analysis, Alex Heath, stated that the decline in the value of the Australian dollar has helped boost trade competitiveness and that the nation’s labour market is likely to strengthen over the course of the year.

LME Copper prices declined 1.26% or $59.0 /MT to $4610.0 /MT. Aluminium prices declined 0.55% or $8.0 /MT to $1446.0 /MT.

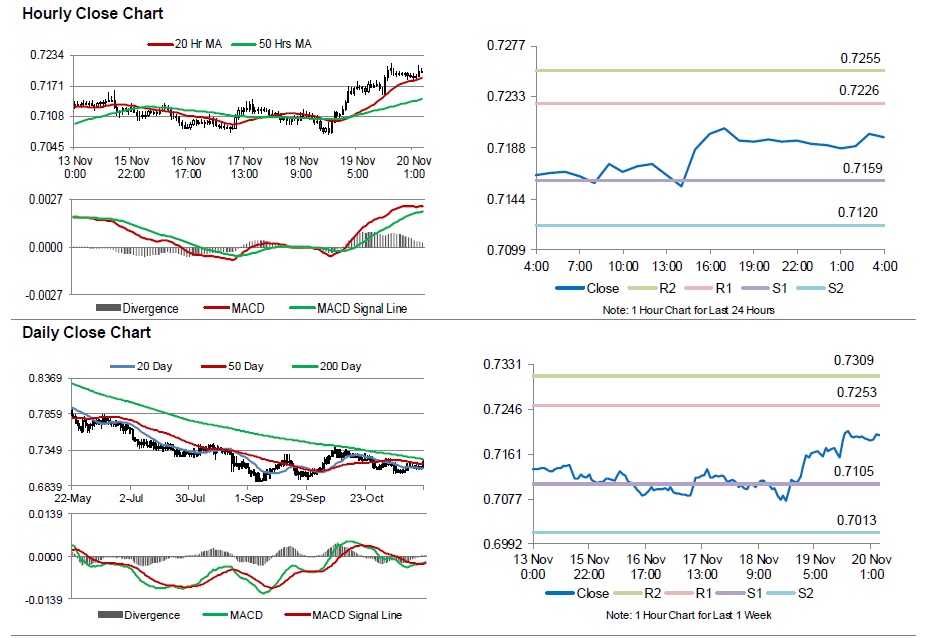

In the Asian session, at GMT0400, the pair is trading at 0.7197, with the AUD trading marginally higher from yesterday’s close.

Early morning data showed that in China, Australia’s largest trading partner, the CB leading economic index increased 0.6% MoM in October, compared to a 1.6% rise in the previous month.

The pair is expected to find support at 0.7159, and a fall through could take it to the next support level of 0.712. The pair is expected to find its first resistance at 0.7226, and a rise through could take it to the next resistance level of 0.7255.

Moving ahead, investors will look forward to Australia’s Westpac-MNI consumer sentiment index data for November, scheduled to be released next week. Additionally, China’s industrial profits data for October, due next week, will also grab a significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.