For the 24 hours to 23:00 GMT, the USD declined 0.14% against the CAD to close at 1.3293.

In economic news, Canada’s wholesale sales unexpectedly declined 0.1% MoM in September, against market expectations for a 0.2% increase. In the previous month, it had recorded a revised flat reading.

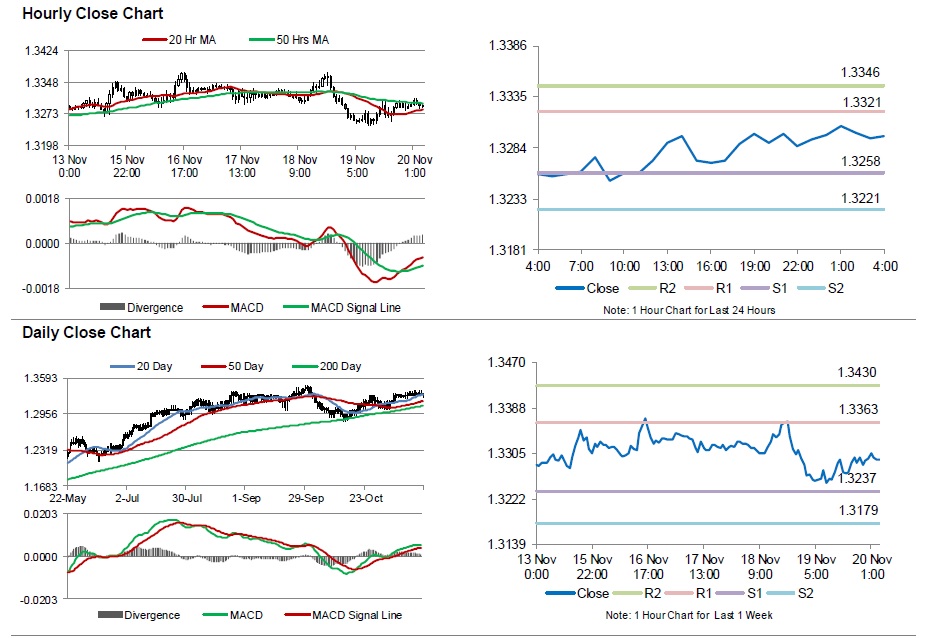

In the Asian session, at GMT0400, the pair is trading at 1.3295, with the USD trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.3258, and a fall through could take it to the next support level of 1.3221. The pair is expected to find its first resistance at 1.3321, and a rise through could take it to the next resistance level of 1.3346.

Going ahead, market participants will keep a close watch on Canada’s retail sales and consumer price inflation data, scheduled later today, to gauge the strength in the nation’s economy.

The currency pair is trading above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.