For the 24 hours to 23:00 GMT, the AUD strengthened 0.07% against the USD to close at 0.9412.

LME Copper prices rose 0.3% or $18.0/MT to $ 7173.0/MT. Aluminium prices rose 0.7% or $13.5/MT to $ 1924.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.9404, with the AUD trading 0.08% lower from yesterday’s close, after data released earlier this morning indicated that the unemployment rate in Australia reached an 11-year high and climbed to a seasonally adjusted 6.0% in June, compared to a revised rate of 5.9% reported in May. Markets were expecting the unemployment rate to remain steady at 5.9% in June. However, the number of people employed in Australia rose more-than-expected by 15.9K in June, compared to a revised fall of 5.1K in the previous month.

The Aussie continued to trade under pressure after the trade surplus in China, Australia’s largest trading partner, unexpectedly narrowed to $31.6 billion in June, from a surplus of $35.9 billion recorded in the previous month. Markets had expected China’s trade surplus to widen to $37.0 billion in June.

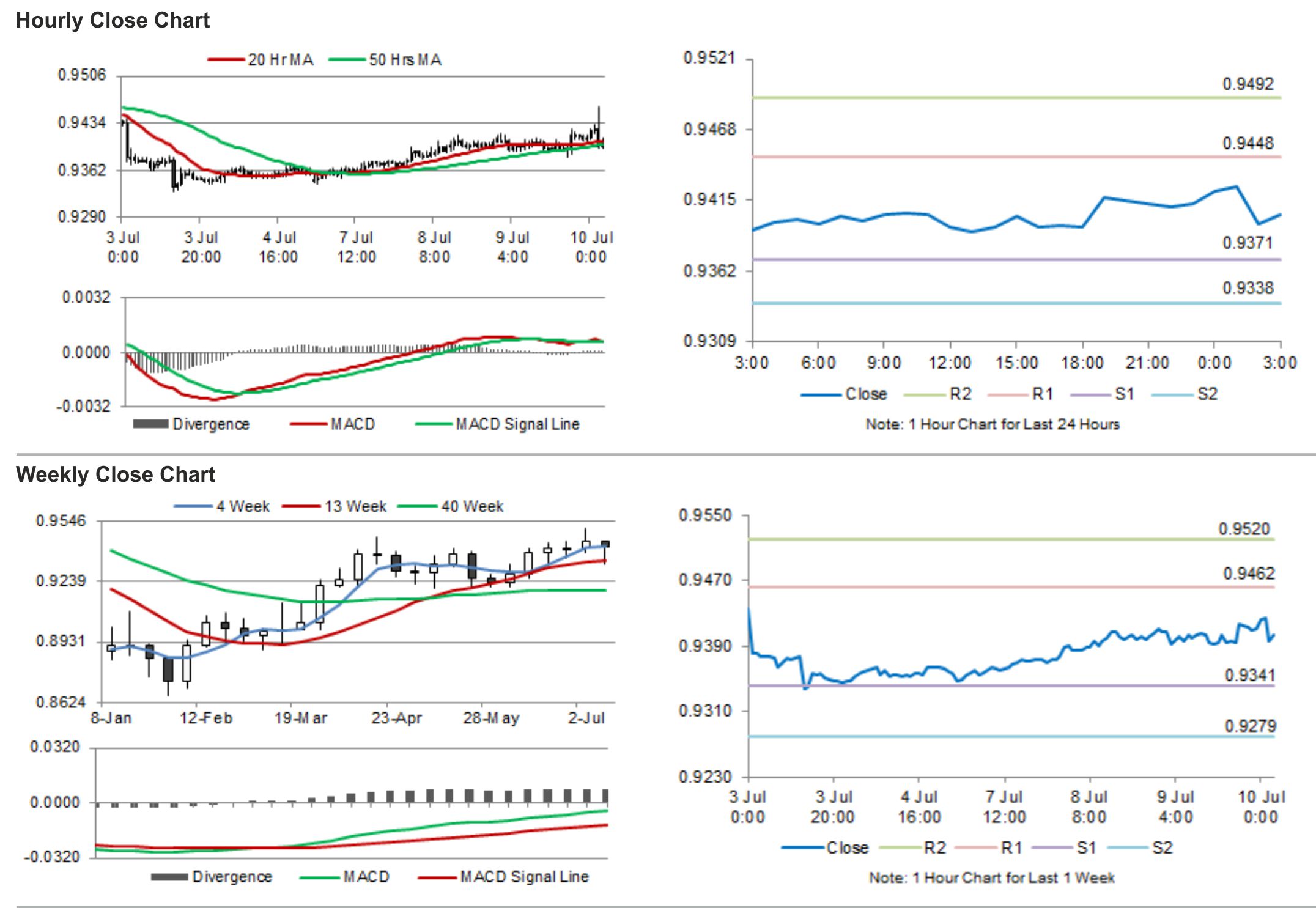

The pair is expected to find support at 0.9371, and a fall through could take it to the next support level of 0.9338. The pair is expected to find its first resistance at 0.9448, and a rise through could take it to the next resistance level of 0.9492.

With no more releases scheduled during the day, traders would await homes loans data for May, slated to release early tomorrow.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.