For the 24 hours to 23:00 GMT, the USD declined 0.20% against the CAD to close at 1.0653.

The Canadian Dollar traded higher, on the back of stronger than expected figures for Canadian housing starts data. The housing starts in Canada on seasonally adjusted basis jumped to an annual rate of 198.2K units in June, compared to a revised increase of 197.0K in the previous month. Markets expected housing starts to fall to 190.0K units.

Meanwhile, a private study conducted by Centre for Digital Entrepreneurship and Economic Performance (DEEP Centre) in Canada, revealed that the Canadian economy is much more dependent on smaller firms than other similar economies.

In the Asian session, at GMT0300, the pair is trading at 1.0651, with the USD trading marginally lower from yesterday’s close.

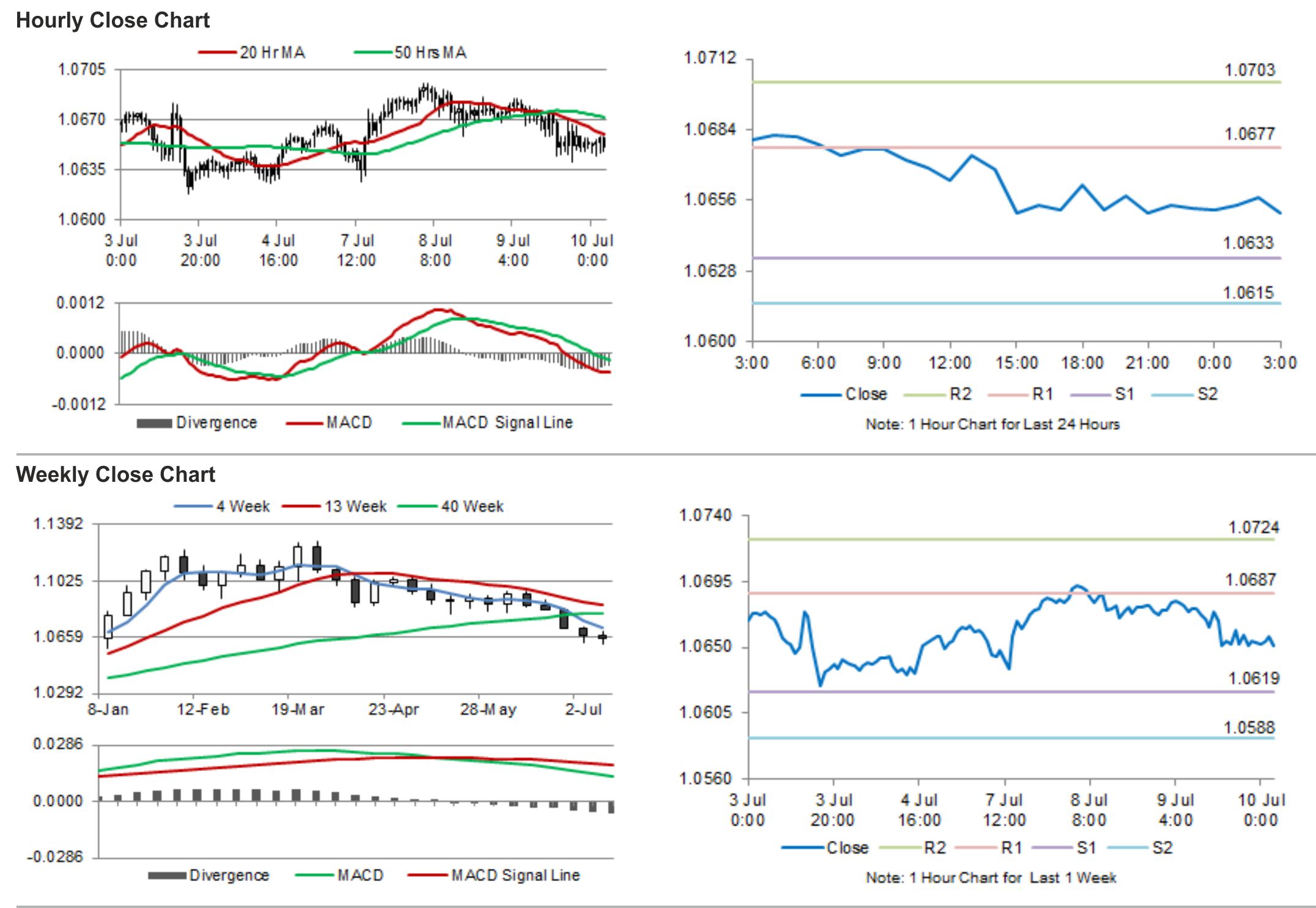

The pair is expected to find support at 1.0633, and a fall through could take it to the next support level of 1.0615. The pair is expected to find its first resistance at 1.0677, and a rise through could take it to the next resistance level of 1.0703.

Trading trends in the pair today are expected to be determined by the Canadian new housing price index for May, to be released later during the day.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.