For the 24 hours to 23:00 GMT, the AUD weakened 1.39% against the USD to close at 0.7019, as manufacturing activity in China, Australia’s biggest trading partner fell into contraction territory in the month of August.

LME Copper prices remained unchanged at yesterday’s price of $5095.0/MT. Aluminium prices rose 1.77% or $27.5/MT to $1577.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7017, with the AUD trading a tad lower from yesterday’s close.

Early morning data showed that Australia’s Q2 GDP grew 0.2% QoQ for the three months through June, disappointing market expectations for a gain of 0.4% and compared to a rise of 0.9% in the preceding quarter, as construction and mining activity in the nation weakened along with a decline in exports.

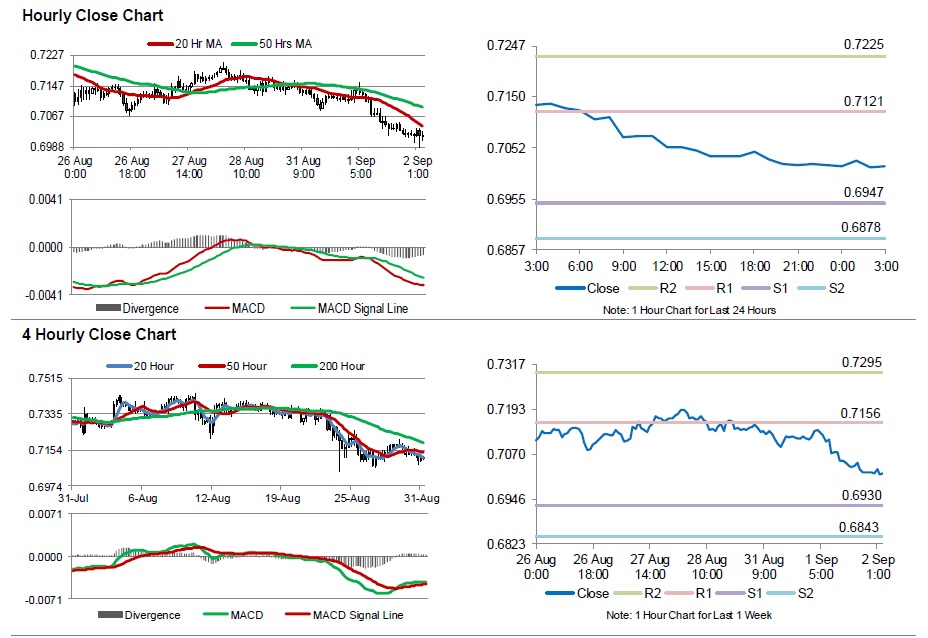

The pair is expected to find support at 0.6947, and a fall through could take it to the next support level of 0.6878. The pair is expected to find its first resistance at 0.7121, and a rise through could take it to the next resistance level of 0.7225.

Moving ahead, investors would keep a close eye on Australia’s retail sales and trade balance data, set for release in the early hours tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.