For the 24 hours to 23:00 GMT, the USD rose 0.79% against the CAD to close at 1.3247.

The CAD weakened, after Canada’s annualized GDP shrank 0.50% in 2Q 2015, following a revised drop of 0.80% in the first three months of the year, thus contracting for two consecutive quarters, as lower oil prices and slow global economic growth continued to weigh on the nation’s economy. Meanwhile, a slight monthly rebound in June’s GDP suggested that the Canadian economy was coming out of the economic mire.

Other economic data showed that Canada’s RBC manufacturing PMI hit a four-month low level of 49.4 in August, after registering a reading of 50.8 in the preceding month, thereby highlighting that the country’s manufacturing sector continued to face headwinds.

In the Asian session, at GMT0300, the pair is trading at 1.3238, with the USD trading 0.07% lower from yesterday’s close.

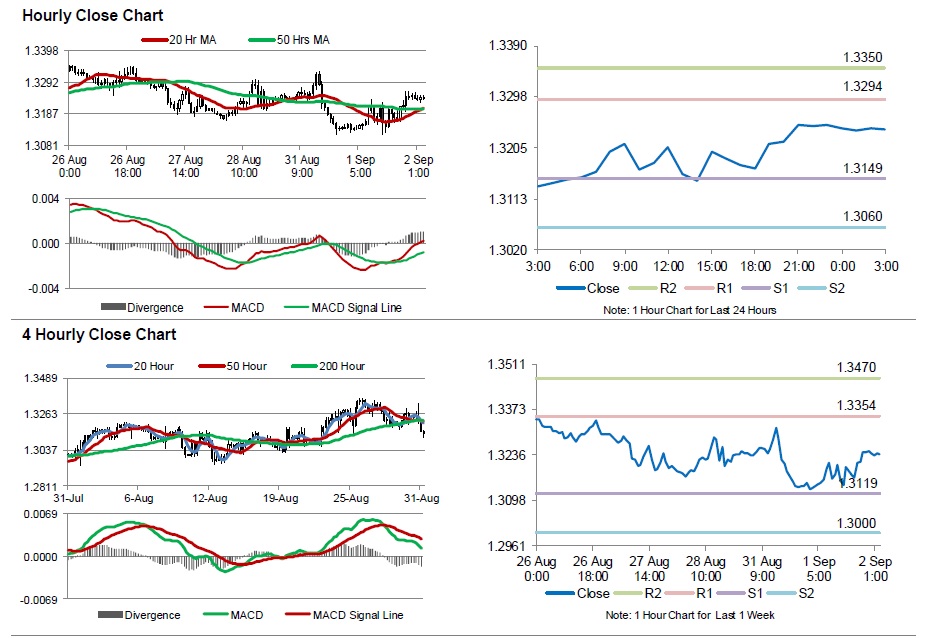

The pair is expected to find support at 1.3149, and a fall through could take it to the next support level of 1.3060. The pair is expected to find its first resistance at 1.3294, and a rise through could take it to the next resistance level of 1.3350.

With no economic releases in Canada today, market participants look forward to the release of the nation’s employment data, scheduled on Friday.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.