For the 24 hours to 23:00 GMT, the AUD rose 0.32% against the USD and closed at 0.7481.

LME Copper prices rose 0.81% or $47.5/MT to $5903.5/MT. Aluminium prices rose 0.58% or $10.0/MT to $1728.0/MT.

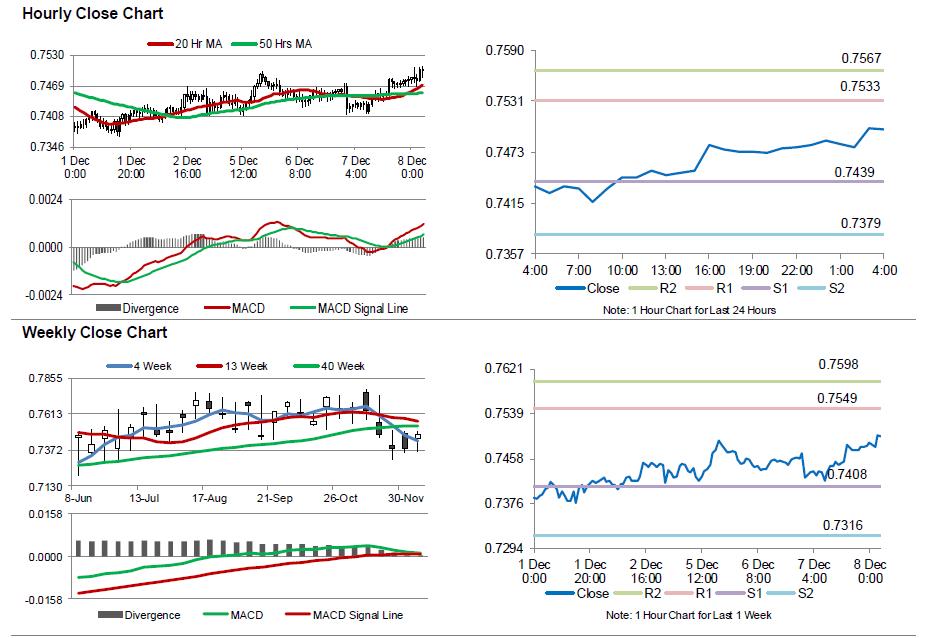

In the Asian session, at GMT0400, the pair is trading at 0.7499, with the AUD trading 0.24% higher against the USD from yesterday’s close.

Earlier in the session, Australia’s seasonally adjusted trade deficit unexpectedly expanded to a level of A$1541.0 million in October, from a revised trade deficit of A$1272.0 million in the prior month, whereas market expectation was for the nation’s trade deficit to drop to a level of A$610.0 million.

Elsewhere in China, Australia’s largest trading partner, trade surplus narrowed more-than-expected to a level of CNY298.1 billion in November, following a trade surplus of CNY325.3 billion and compared to market expectations for the nation to post a trade surplus of CNY316.5 billion. Meanwhile, the nation’s annual exports rebounded 5.9% in November and annual imports surged 13.0% in the same month.

The pair is expected to find support at 0.7439, and a fall through could take it to the next support level of 0.7379. The pair is expected to find its first resistance at 0.7533, and a rise through could take it to the next resistance level of 0.7567.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.