For the 24 hours to 23:00 GMT, the USD declined 0.37% against the CAD and closed at 1.3227.

Yesterday, the Bank of Canada (BoC), in its recent monetary policy meeting, held the benchmark interest rate steady at 0.50%, stating that Canadian economy experienced a healthy rebound in the third quarter, following a slump earlier in the year and is growing as expected, despite lingering uncertainty in the US and its other major trading partners. The central bank further added that although the nation’s growth rebounded strongly during the third quarter, the economy is expected to shift to moderate growth in the fourth quarter, as business investment and non-energy goods exports continue to disappoint.

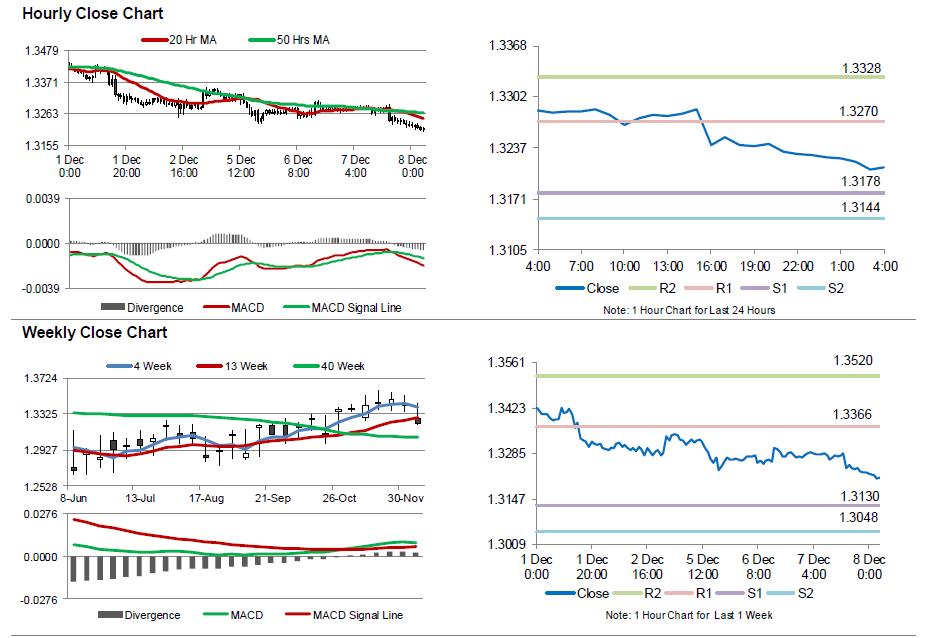

In the Asian session, at GMT0400, the pair is trading at 1.3211, with the USD trading 0.12% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.3178, and a fall through could take it to the next support level of 1.3144. The pair is expected to find its first resistance at 1.327, and a rise through could take it to the next resistance level of 1.3328.

Looking forward, market participants would keep a close watch on Canada’s housing starts and building permits data, due to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.