For the 24 hours to 23:00 GMT, the AUD declined 0.29% against the USD and closed at 0.7596.

LME Copper prices rose 2.22% or $107.0/MT to $4918.5/MT. Aluminium prices rose 1.43% or $23.5/MT to $1669.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7632, with the AUD trading 0.47% higher against the USD from yesterday’s close.

Early morning data indicated that Australia’s seasonally adjusted unemployment rate climbed to 5.8% in June, in line with market expectations and hitting its highest level in four-months, thus making it more likely that the Reserve Bank of Australia (RBA) will cut interest rate next month. The unemployment rate had registered a rise of 5.7% in the prior month. On the other hand, the nation’s consumer inflation expectations advanced to 3.7% in July, after recording a level of 3.5% in the prior month.

Separately, in China, Australia’s largest trading partner, data indicated that trade surplus narrowed more-than-expected to $48.11 billion in June, compared to market expectations of a trade surplus of $45.65 billion and after posting a trade surplus of $49.98 billion in the previous month, thus indicating economic slowdown in world’s second largest economy. Additionally, the nation’s exports dropped less than expected by 4.8% in June, compared to a fall of 4.1% in the previous month. Also, the nation’s imports eased more-than-anticipated by 8.4% in June, compared to a drop of 6.2% in the previous month.

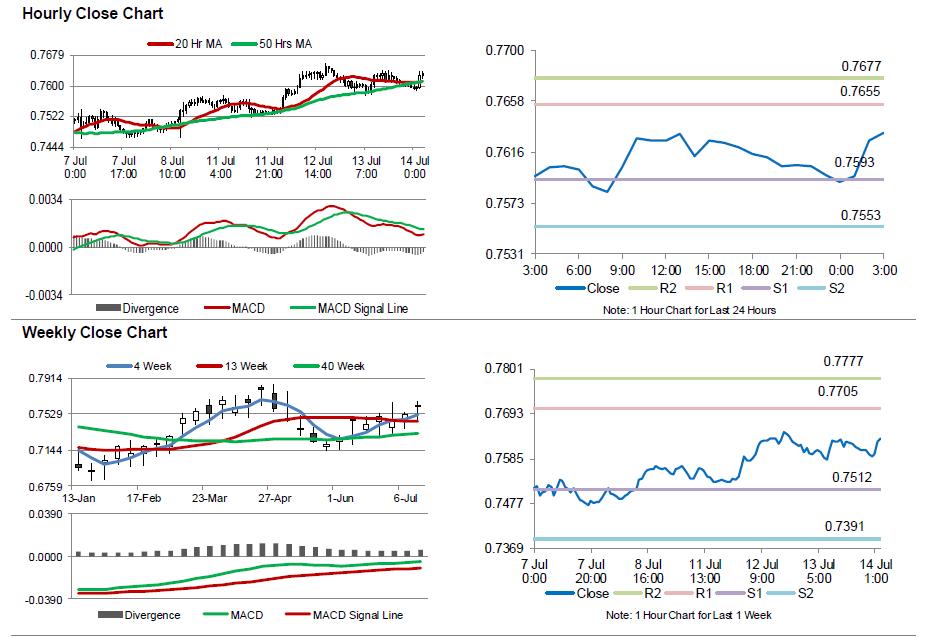

The pair is expected to find support at 0.7593, and a fall through could take it to the next support level of 0.7553. The pair is expected to find its first resistance at 0.7655, and a rise through could take it to the next resistance level of 0.7677.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.