For the 24 hours to 23:00 GMT, the USD declined 0.49% against the CAD and closed at 1.2979.

The Canadian Dollar gained ground yesterday, after the Bank of Canada (BoC), in a widely expected move, held its key interest rate steady at 0.5%. The central bank downgraded Canada’s near-term outlook as it forecasted the nation’s GDP to grow by 1.3% in 2016, in response to a weaker investment outlook and sluggish exports. It also stated that Canadian economy grew by 2.4% in the first quarter but is estimated to have contracted by 1% in the second quarter of the year, weighed down by volatile trade flows, uneven consumer spending, and the Alberta wildfires. Further, it indicated that the nation’s economy will return to full output towards the end of 2017 while downplaying the impact of the UK’s vote to leave the European Union.

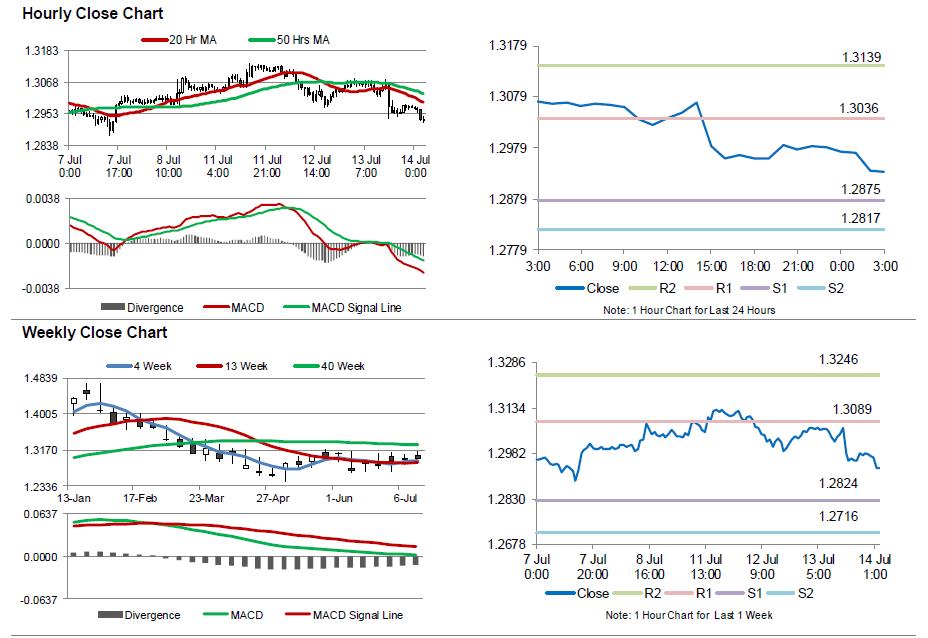

In the Asian session, at GMT0300, the pair is trading at 1.2932, with the USD trading 0.36% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.2875, and a fall through could take it to the next support level of 1.2817. The pair is expected to find its first resistance at 1.3036, and a rise through could take it to the next resistance level of 1.3139.

Moving ahead, Canada’s new housing price index data, slated to be released later in the day, will be on investor’s radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.