For the 24 hours to 23:00 GMT, the AUD weakened 0.65% against the USD to close at 0.9325.

Yesterday, the IMF stated that Australia’s largest trading partner, China would register economic growth at about 7.5% in 2014, with inflation kept below 3%. The agency raised concerns over China’s increasing levels of debt and need for economic reform, and urged for quicker reforms in the nation.

LME Copper prices declined 0.4% or $26.0/MT to $7090.0/MT. Aluminium prices rose 0.4% or $8.5/MT to $1982.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.9328, with the AUD trading tad higher from yesterday’s close, despite data revealing that the Australian building approvals, on a monthly basis, fell by 5.0% in June from 10.3% rise in the previous month, while the markets had expected a 2% fall.

Additionally, export price index plunged 7.9% in the second quarter, its biggest quarterly fall since late 2010. Simultaneously, the import price index in Australia eased 3.0% in Q2, on a quarterly basis, compared to a 3.2% rise in the previous quarter, thus registering its biggest fall since the fourth quarter of 2010. On the other hand, private sector credit in Australia climbed 0.7% in June, compared to market expectations of similar rise recorded in the previous month of 0.4%.

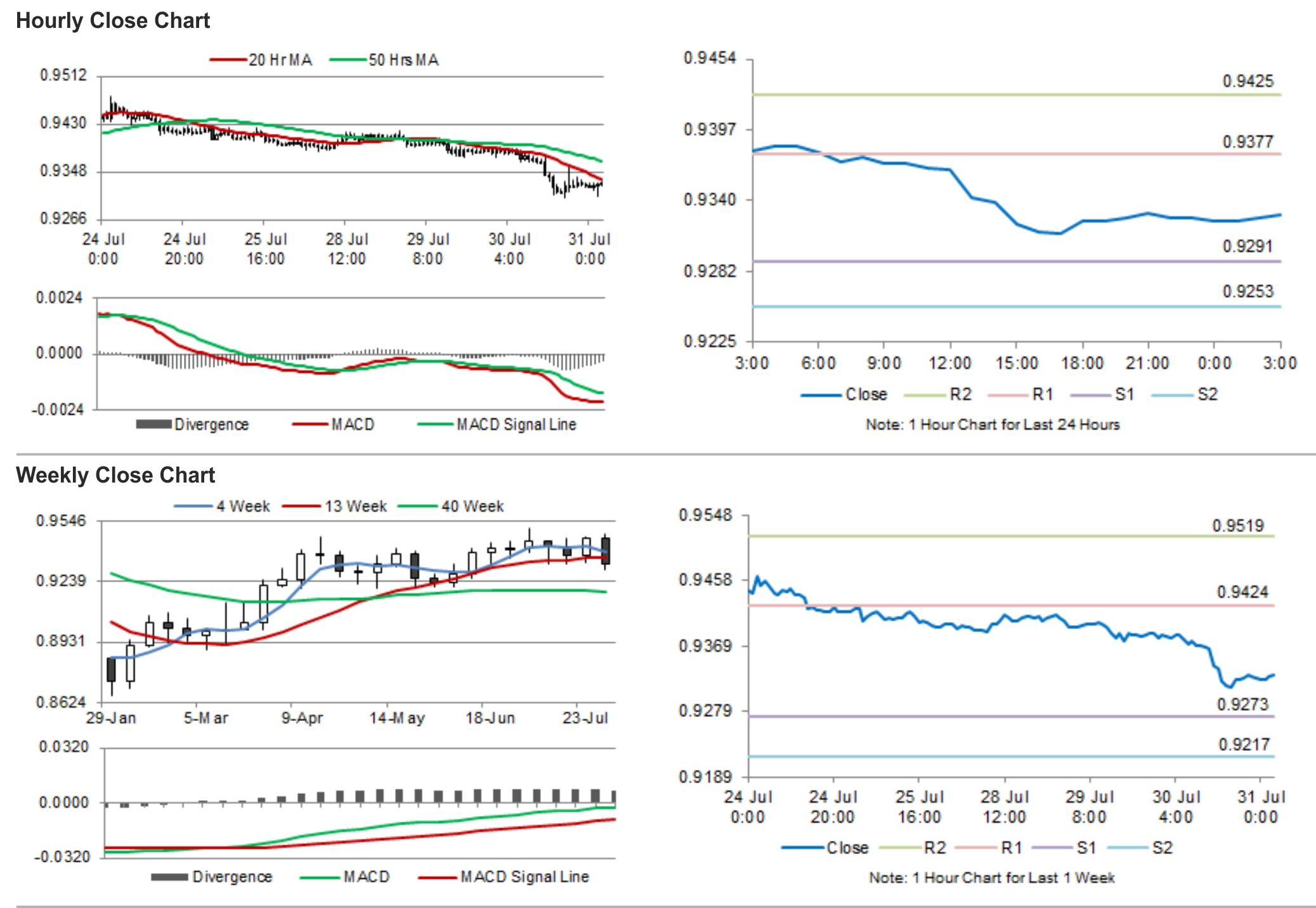

The pair is expected to find support at 0.9291, and a fall through could take it to the next support level of 0.9253. The pair is expected to find its first resistance at 0.9377, and a rise through could take it to the next resistance level of 0.9425.

Trading trends in the Australian Dollar today are expected to be determined by the overnight release of AiG Performance of Manufacturing Index.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.