For the 24 hours to 23:00 GMT, the USD rose 0.50% against the CAD to close at 1.0905 after the Fed’s upbeat assessment of the US economy.

In economic news, the industrial product price index in Canada unexpectedly fell 0.1% in June, on a monthly basis, beating the market expectations for a rise of 0.2%. In the previous month, the industrial product price index had recorded a drop of 0.5%. On the other hand, raw material price index in Canada advanced 1.1% in June compared to a drop of 0.3%, on monthly basis, in the prior month. The market expectations were for it to rise 0.6%.

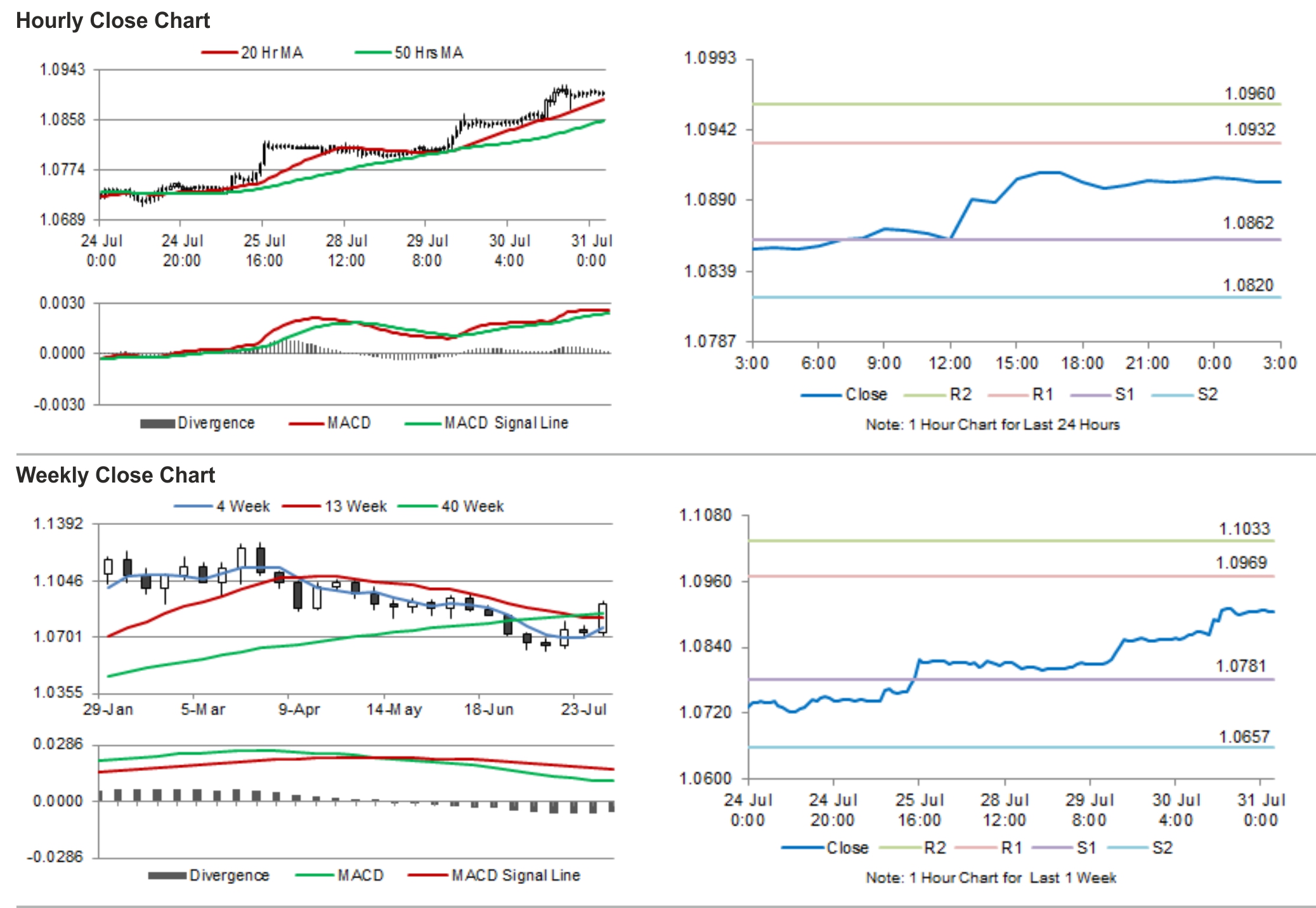

In the Asian session, at GMT0300, the pair is trading at 1.0904, with the USD trading tad lower from yesterday’s close.

The pair is expected to find support at 1.0862, and a fall through could take it to the next support level of 1.0820. The pair is expected to find its first resistance at 1.0932, and a rise through could take it to the next resistance level of 1.0960.

Investors would keep a close eye on Canada’s GDP, scheduled later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.