For the 24 hours to 23:00 GMT, the AUD strengthened 0.47% against the USD to close at 0.7531.

LME Copper prices rose 2.85% or $136.5/MT to $4920.0/MT. Aluminium prices rose 0.49% or $8.0/MT to $1653.0/MT.

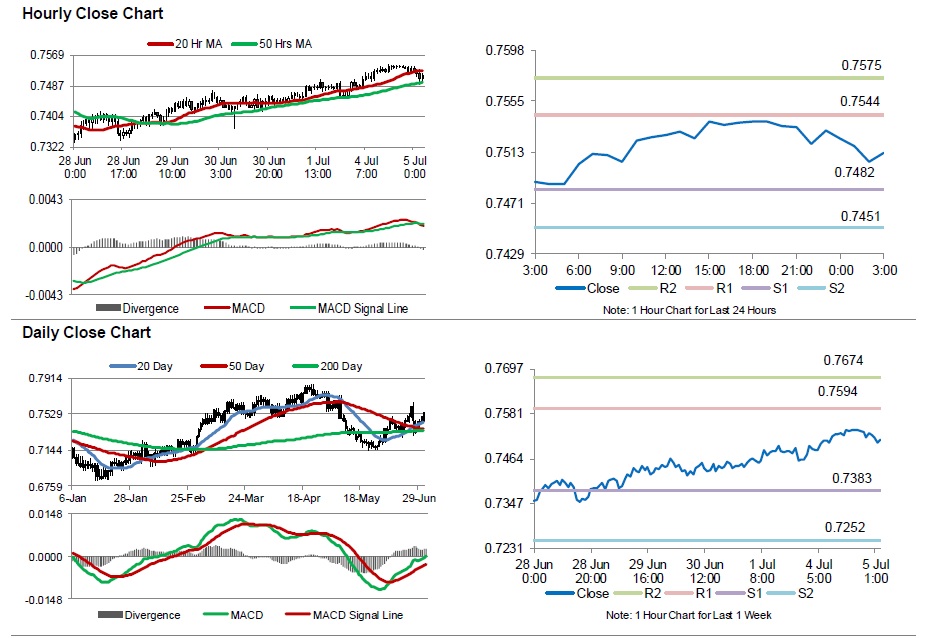

In the Asian session, at GMT0300, the pair is trading at 0.7513, with the AUD trading 0.24% lower against the USD from yesterday’s close.

Overnight data showed that Australia’s AiG performance of services index dropped to a level of 51.3 in June, from a reading of 51.5 in the previous month.

Early this morning, the Reserve Bank of Australia (RBA) left the official cash rate unchanged at 1.75%, in a widely expected move. The policymakers judged that it would be prudent to hold monetary policy steady at this meeting, amid the looming global uncertainty in the wake of Britain’s decision to leave the European Union. Further, the RBA Governor, Glenn Stevens, indicated that Australia’s inflation data, due towards the end of this month, will be a decisive factor in whether the cash rate should be dropped further.

In other economic news, Australia’s seasonally adjusted retail sales rose less-than-expected by 0.2% MoM in May, following a revised 0.1% rise in the previous month. Moreover, the nation’s trade deficit widened to A$2218.0 million in May, compared to a revised trade deficit of A$1785.00 million in the previous month. Meanwhile, the nation’s imports advanced 2.0% and exports rose 1.0% in May.

Separately, in China, Australia’s largest trading partner, Caixin services PMI rose to a 11-month high level of 52.7 in June, from a reading of 51.2 in the previous month.

The pair is expected to find support at 0.7482, and a fall through could take it to the next support level of 0.7451. The pair is expected to find its first resistance at 0.7544, and a rise through could take it to the next resistance level of 0.7575.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.