For the 24 hours to 23:00 GMT, the USD declined 0.31% against the CAD to close at 1.2852.

In economic news, Canada’s RBC manufacturing PMI fell to a level of 51.8 in June and notched its weakest figure since March 2016, compared to a reading of 52.1 in the previous month.

Separately, the Bank of Canada’s (BoC) second quarter business outlook survey indicated that business sentiment in Canada remains subdued as weak commodity prices continue to weigh on firms’ investment intentions. Overall, business investment decisions are mainly being held back by uncertainty along with modest domestic and foreign demand. Further, the firms expect to see only a marginal acceleration in sales growth over the next twelve months.

In the Asian session, at GMT0300, the pair is trading at 1.2873, with the USD trading 0.16% higher against the CAD from yesterday’s close.

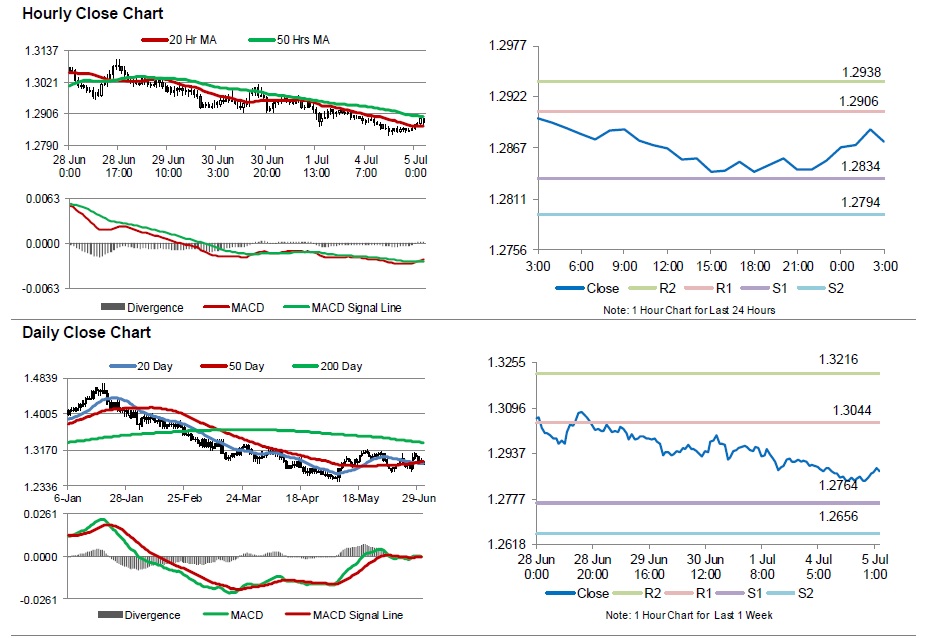

The pair is expected to find support at 1.2834, and a fall through could take it to the next support level of 1.2794. The pair is expected to find its first resistance at 1.2906, and a rise through could take it to the next resistance level of 1.2938.

With no economic releases in Canada today, market participants will look forward to the nation’s international merchandise trade balance data for May, scheduled to release tomorrow.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.