For the 24 hours to 23:00 GMT, AUD weakened 0.36% against the USD to close at 1.0720, on increased risk aversion, as the Greek leaders continue to discuss austerity measures required to receive additional bailout funds, raising concern over the Euro-zone debt crisis.

Unexpected decline in Australian retail spending also weighed on the Aussie.

Elsewhere, the International Monetary Fund stated that the Chinese economy would experience nearly 4% points reduction in its growth rate projected for this year if the debt crisis in Europe intensifies.

In the Asian session, at GMT0400, the pair is trading at 1.0779, with the AUD trading 0.55% higher from yesterday’s close.

This morning, Australia’s central bank unexpectedly kept its key cash rate on hold at 4.25%.

Australian Governor, Glenn Stevens stated that with growth expected to be close to trend and inflation close to target, the Board judged that the current setting of monetary policy was appropriate for the moment.

Meanwhile, the AIG Australian Performance of Construction Index fell 1.2 points to 39.8 in January.

LME Copper prices rose 1.7% or $145.0/MT to $8462.5/ MT. Aluminium prices rose 0.8% or $16.8/MT to $2175.3/ MT.

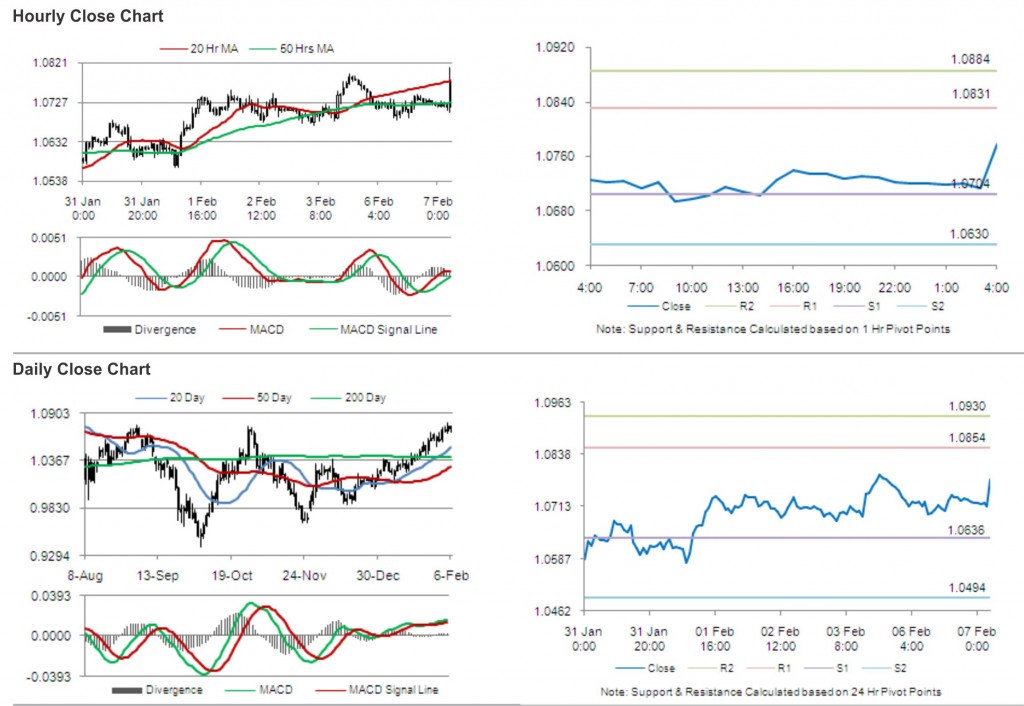

The pair is expected to find support at 1.0704, and a fall through could take it to the next support level of 1.0630. The pair is expected to find its first resistance at 1.0831, and a rise through could take it to the next resistance level of 1.0884.

Aussie is likely to receive increased market attention, with Westpac consumer confidence data due to be released later today.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.