For the 24 hours to 23:00 GMT, USD rose 0.27% against the CAD to close at 0.9963.

The Canadian dollar was pressurized as Greek leaders struggled with austerity measures to get a bailout, reducing demand for riskier assets. Decline in oil prices further weighed on CAD.

Meanwhile, on a seasonally adjusted basis, the Ivey Purchasing Managers’ Index in Canada rose unexpectedly to 64.1 in January, from a reading of 63.5 in December.

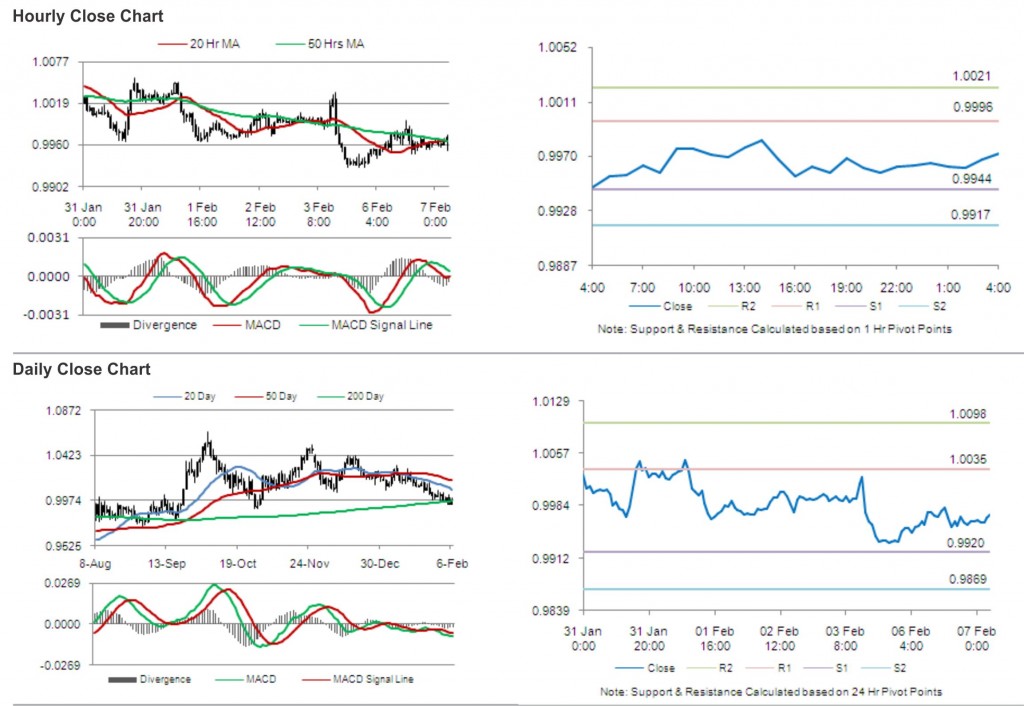

In the Asian session, at GMT0400, the pair is trading at 0.9972, with the USD trading 0.09% higher from yesterday’s close.

The pair is expected to find support at 0.9944, and a fall through could take it to the next support level of 0.9917. The pair is expected to find its first resistance at 0.9996, and a rise through could take it to the next resistance level of 1.0021.

Trading trends in the pair today are expected to be determined by the release of building permits in Canada.

The currency pair is converging with its 20 Hr and 50 Hr moving averages.