For the 24 hours to 23:00 GMT, the AUD weakened 0.22% against the USD to close at 0.8561, after Australia’s AiG performance of construction index dropped to 53.4 in October, after registering a level of 59.1 in the prior month.

LME Copper prices rose 0.53% or $35.0/MT to $6681.0/MT. Aluminium prices rose 0.69% or $14.0/MT to $2052.0/MT.

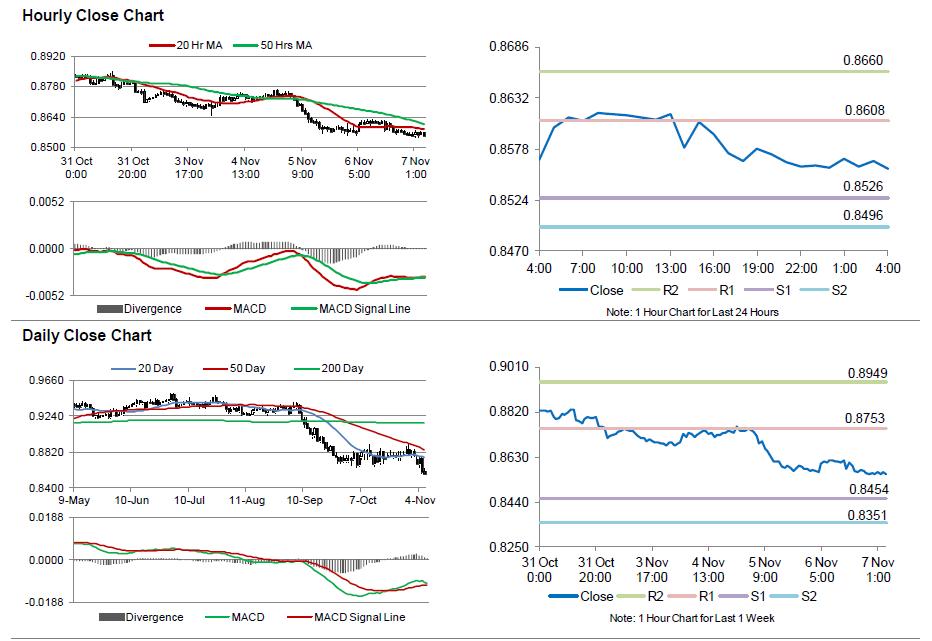

In the Asian session, at GMT0400, the pair is trading at 0.8557, with the AUD trading a tad lower from yesterday’s close.

Earlier today, the RBA in its latest monetary policy statement expressed optimism over the nation’s current monetary policy and further indicated that it would continue to boost demand and the nation’s economic growth. Additionally, the central bank expressed concerns over the “over-valued” Aussie, as it was hampering the nation’s economic growth. However, it lowered Australia’s inflation growth to 1.75% in the year ended 2014, compared to its previous estimation of 2% made in August.

The pair is expected to find support at 0.8526, and a fall through could take it to the next support level of 0.8496. The pair is expected to find its first resistance at 0.8608, and a rise through could take it to the next resistance level of 0.866.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.