For the 24 hours to 23:00 GMT, the USD rose 0.27% against the CAD to close at 1.1426. The CAD traded on a weaker footing, after Canadian Ivey PMI on a seasonally adjusted basis dropped to a 2-month low level of 51.2 in October, exceeding market expectations to ease to a reading of 57.5. The index had climbed to a mark of 58.6 in September.

In other economic news, building permits in Canada edged up more than expected by 12.7% on a monthly basis in September, against market expectations for a rise of 5.0% and after retreating 27.3% in August.

In the Asian session, at GMT0400, the pair is trading at 1.1441, with the USD trading 0.13% higher from yesterday’s close.

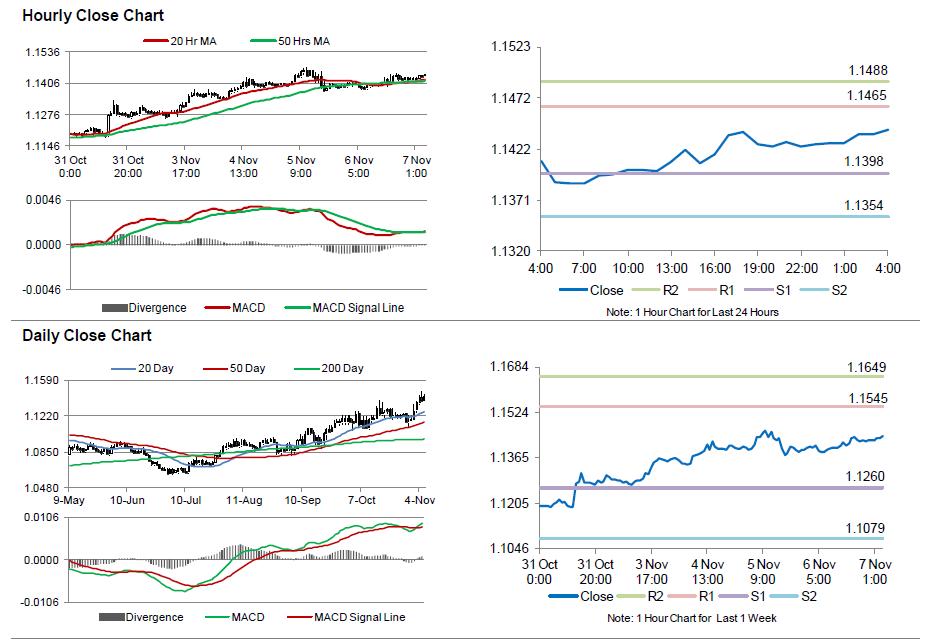

The pair is expected to find support at 1.1398, and a fall through could take it to the next support level of 1.1354. The pair is expected to find its first resistance at 1.1465, and a rise through could take it to the next resistance level of 1.1488.

Trading trends in the CAD today would be governed by Canada’s unemployment rate, scheduled later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.