On Friday, EUR ended the day flat against the USD and closed at 1.3887, paring some of it initial losses after an ECB policymaker, Jens Weidmann opined that he did not see a deflation spiral in the Euro-zone, adding that he expects the Euro-bloc’s economy to pick up and therefore cause the inflation rate to gradually rise. Meanwhile, another ECB official, Ewald Nowotny hinted the possibility for the central bank to alter its monetary policy at its June policy meeting to respond to the low-inflation rate in the region. He further added that he was not in favour of the central bank going for bond-buying programmes to spur economic growth in the region.

In economic news, Germany’s annual consumer inflation rate fell to a three-year low 1.0% in March, in-line with economists’ estimates and compared to previous month’s level of 1.2%. Meanwhile, current account deficit in France narrowed to €1.4 billion in February, following a €3.7 billion deficit in January.

During the weekend, the ECB President, Mario Draghi, highlighted the impact of the Euro on the region’s price stability and stated that a further appreciation in the Euro exchange rate could compel the central bank to add to its monetary stimulus measures in the region. Likewise, an ECB Executive Board member, Benoit Coeure also indicated that the central bank could consider assets purchases to hold down long-term interest rates and to keep inflation in the economy from staying too low for too long.

Separately, the IMF reiterated its concerns on the low-level of inflation in the Euro-zone economy and highlighted the need for the ECB to undertake more resolute actions, as according to the fund, the overall Euro-zone is likely to undershoot the central bank’s target by “substantial margins.”

Meanwhile, in the US, the producer-price index registered its strongest increase in nine months in March while the US Reuters/ Michigan consumer confidence index rose to the highest level since July 2013 in April.

In the Asian session, at GMT0300, the pair is trading at 1.3853, with the EUR trading 0.24% lower from Friday’s close.

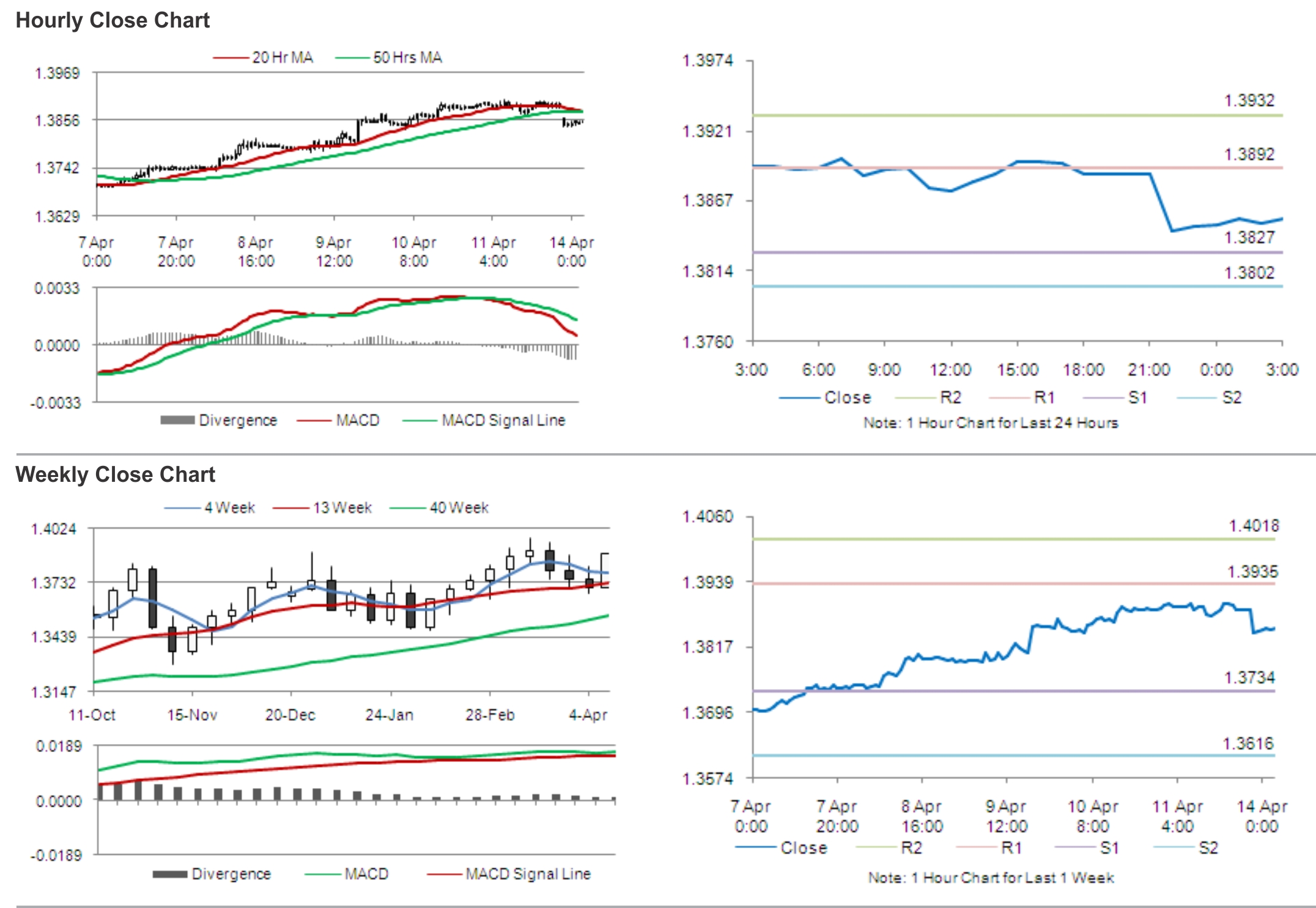

The pair is expected to find support at 1.3827, and a fall through could take it to the next support level of 1.3802. The pair is expected to find its first resistance at 1.3892, and a rise through could take it to the next resistance level of 1.3932.

Traders are expected to keep a tab on Euro-zone’s industrial production and Italy’s consumer inflation data for further cues in the Euro.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.