On Friday, GBP fell 0.19% against the USD and closed at 1.6745, as the greenback advanced following upbeat US producer inflation and consumer sentiment data.

On the macro front, construction output in the UK declined 2.8% (MoM) in February, its biggest fall since November last year, owing to severe bad weather while the CB leading index for the UK economy rose 0.4% (MoM) in February, signalling that the recovery is set to continue in coming months.

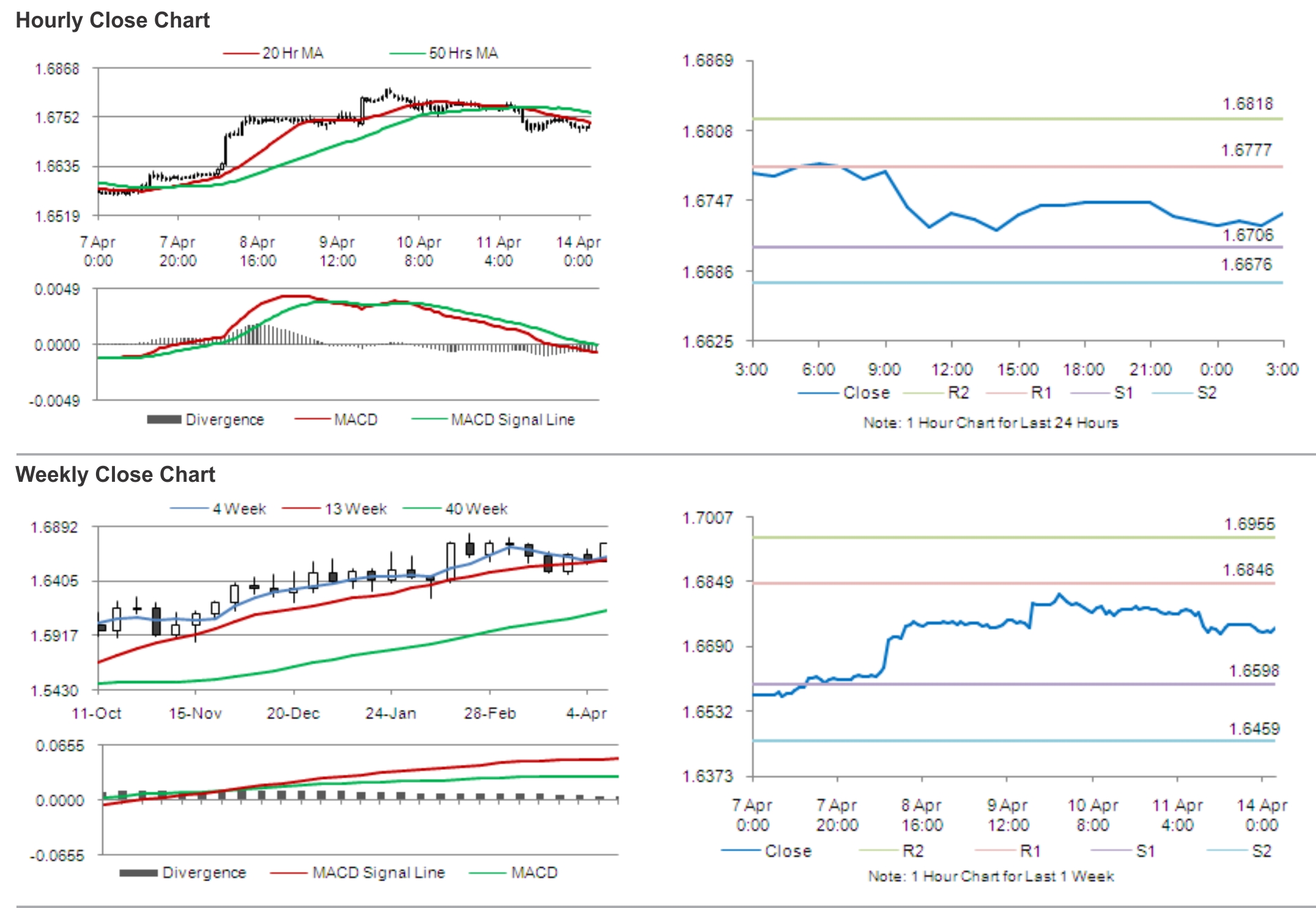

In the Asian session, at GMT0300, the pair is trading at 1.6736, with the GBP trading marginally lower from Friday’s close.

Early morning, Rightmove reported that its index on the UK‘s house price hit a fresh record high of 2.6% (MoM) for a second straight month of rise in April.

The pair is expected to find support at 1.6706, and a fall through could take it to the next support level of 1.6676. The pair is expected to find its first resistance at 1.6777, and a rise through could take it to the next resistance level of 1.6818.

Market participants are expected to keep a tab on the BRC retail sales monitor data, slated for release later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.