For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.1207.

Yesterday, in its economic bulletin report, the European Central Bank (ECB) indicated that employment in the common currency region is once again growing in line with the gross domestic product (GDP). It further highlighted that global growth recovery will be gradual and uneven with heightened uncertainty and is likely to accelerate next year. However, it also cited that Britain’s decision to leave the European Union and slowdown in Chinese economy has triggered macroeconomic risks and uncertainty over the global economic outlook.

In other economic news, Euro-zone’s flash consumer confidence index improved to a level of -8.2 in September, meeting market expectations, compared to a level of -8.5 in the previous month.

In the US, data showed that the number of Americans filing for fresh unemployment benefits unexpectedly dropped to a level of 252.0K in the week ended 17 September 2016, hitting its lowest level since July, thus pointing towards continuous strength in the nation’s labour market. Meanwhile, markets expected for an advance to a level of 261.0K, following a reading of 260.0K in the prior week. Additionally, the nation’s housing price index advanced by 0.5% on a monthly basis in July, compared to a revised gain of 0.3% in the previous month. On the other hand, the nation’s existing home sales unexpectedly fell by 0.9% on monthly basis in August, declining for the second straight month, after recording a revised drop of 3.4% in the preceding month while markets had envisaged for a gain of 1.1%. Moreover, the nation’s CB leading indicator surprisingly eased by 0.2% MoM in August, compared to a revised rise of 0.5% in the previous month whereas markets had anticipated for a flat reading.

In the Asian session, at GMT0300, the pair is trading at 1.1196, with the EUR trading 0.1% lower against the USD from yesterday’s close.

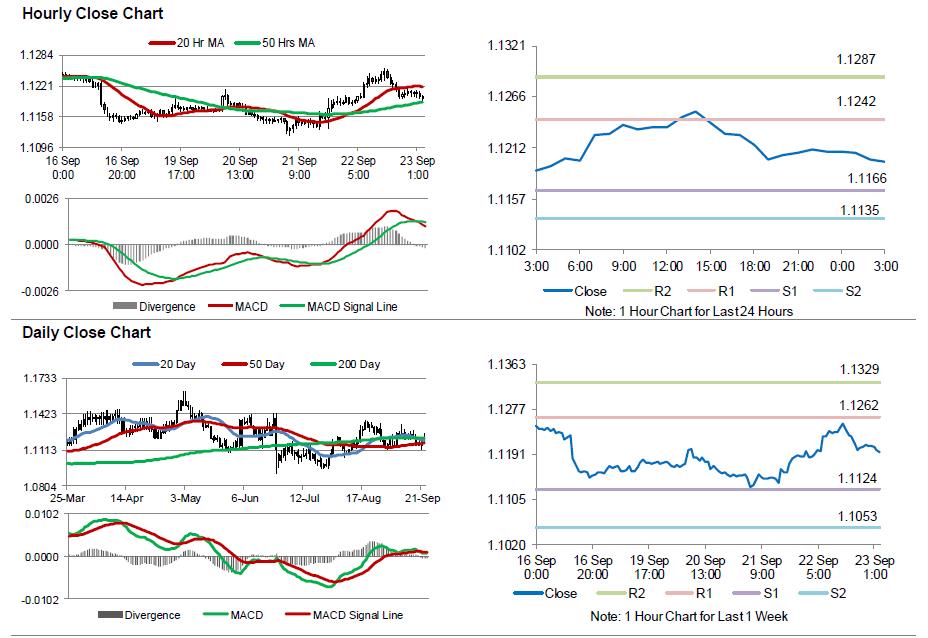

The pair is expected to find support at 1.1166, and a fall through could take it to the next support level of 1.1135. The pair is expected to find its first resistance at 1.1242, and a rise through could take it to the next resistance level of 1.1287.

Moving ahead, investors would keep a close watch on the flash Markit services and manufacturing PMI data for September across the Euro-zone, slated to release in few hours. Moreover, the US preliminary Markit manufacturing PMI data for September, scheduled to release later in the day, would be on investor’s radar.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.