For the 24 hours to 23:00 GMT, the GBP rose 0.35% against the USD and closed at 1.3077, after the Bank of England (BoE) policymaker, Kristen Forbes, stated that there is no need for a further cut in interest rates to boost UK’s economic growth, following Britain’s vote to leave the European Union and also acknowledged that latest economic data suggests that economy would grow faster than the central bank had forecasted last month.

Separately, the BoE’s Financial Policy Committee warned that the outlook for Britain’s financial stability remains challenging, citing concerns derived from the historic Brexit vote as well as volatility in global financial markets.

In other economic news, data indicated that UK’s CBI industrial trends total orders remained steady at a level of -5.0 in August, in line with market expectations.

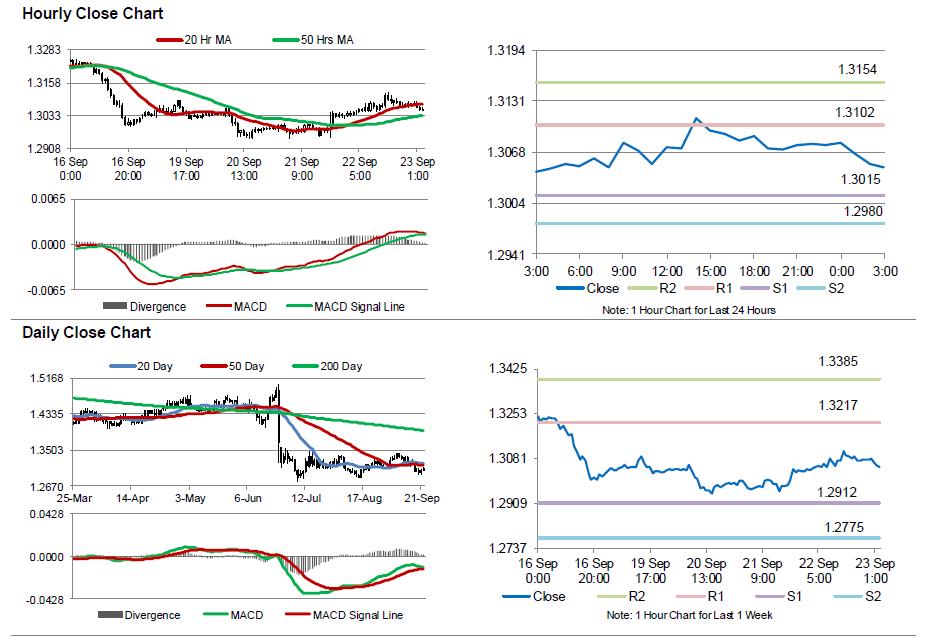

In the Asian session, at GMT0300, the pair is trading at 1.3049, with the GBP trading 0.21% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3015, and a fall through could take it to the next support level of 1.2980. The pair is expected to find its first resistance at 1.3102, and a rise through could take it to the next resistance level of 1.3154.

Amid a lack of macroeconomic releases in UK today, investors look forward to the release of UK’s final GDP for 2Q 2016, Nationwide house prices, mortgage approvals, GfK consumer confidence survey data, all due next week.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.