For the 24 hours to 23:00 GMT, the EUR declined 0.49% against the USD and closed at 1.1029, after the ECB President, Mario Draghi, stated that the central bank will start with the quantitative easing programme from 9 March 2015, wherein it will purchase assets worth €60 billion a month until September 2016 or until inflation reaches back close to the 2% target. Additionally, the ECB kept its key interest rate unchanged at 0.05%. The central bank also upgraded Euro-zone’s growth forecast for 2015 to 1.5% from 1% and indicated that the region’s economy was anticipated to expand by 1.9% and 2.1% in 2016 and 2017, respectively.

Meanwhile, dismal factory orders data in Germany pressurised the EUR further. Data revealed that Germany’s factory orders slid more than expected by 3.9% on a monthly basis in January, compared to market expectations of a 1.0% drop. It had risen by a revised 4.4% in the preceding month.

In the US, initial jobless claims unexpectedly rose to 320 K in the week ended 28 February, up from prior week’s level of 313 K. Markets were expecting it to drop to a level of 295 K. Meanwhile, factory orders in the nation unexpectedly retreated 0.2% in January, higher than market expectations for a 0.2% rise. It had dropped 3.5% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1029, with the EUR trading flat from yesterday’s close.

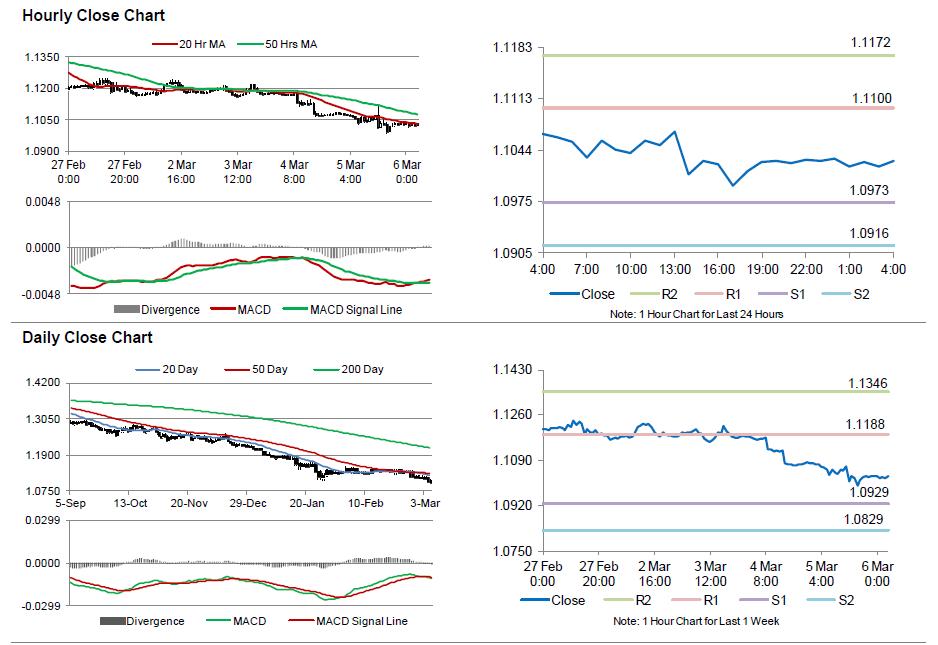

The pair is expected to find support at 1.0973, and a fall through could take it to the next support level of 1.0916. The pair is expected to find its first resistance at 1.11, and a rise through could take it to the next resistance level of 1.1172.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s 4Q GDP data, scheduled in a few hours. Additionally, the US non-farm payrolls and unemployment rate data would generate a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.